Summary

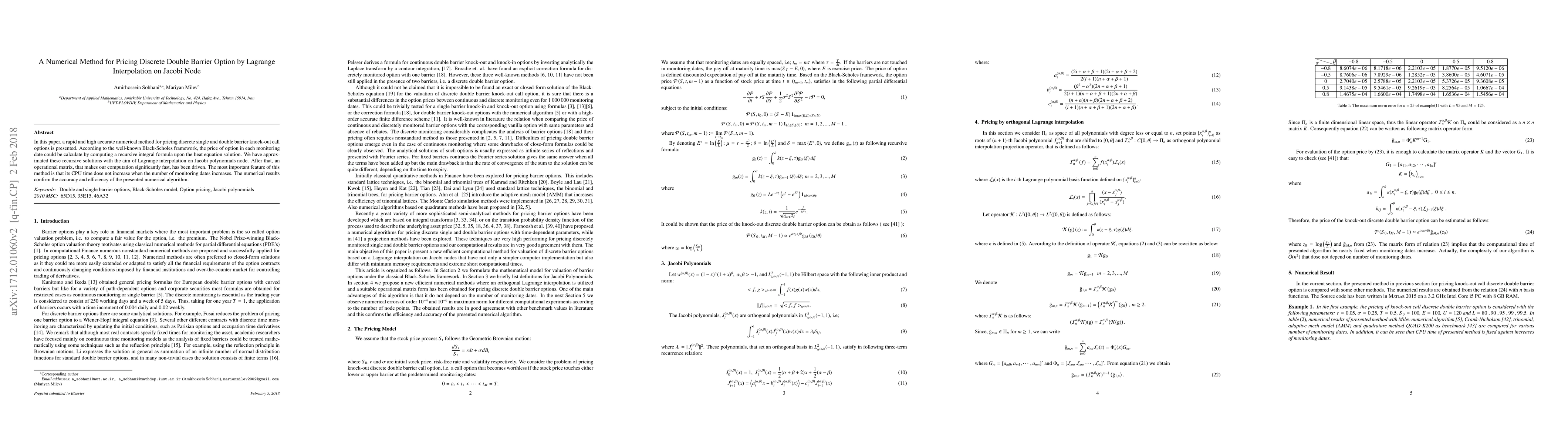

In this paper, a rapid and high accurate numerical method for pricing discrete single and double barrier knock-out call options is presented. According to the well-known Black-Scholes framework, the price of option in each monitoring date could be calculate by computing a recursive integral formula upon the heat equation solution. We have approximated these recursive solutions with the aim of Lagrange interpolation on Jacobi polynomials node. After that, an operational matrix, that makes our computation significantly fast, has been driven. The most important feature of this method is that its CPU time dose not increase when the number of monitoring dates increases. The numerical results confirm the accuracy and efficiency of the presented numerical algorithm.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPath Integral Method for Proportional Step and Proportional Double-Barrier Step Option Pricing

Qi Chen, Chao Guo

Path Integral Method for Pricing Proportional Step Double-Barrier Option with Time Dependent Parameters

Qi Chen, Chao Guo

A Hamiltonian Approach to Floating Barrier Option Pricing

Qi Chen, Chao Guo, Hong-tao Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)