Authors

Summary

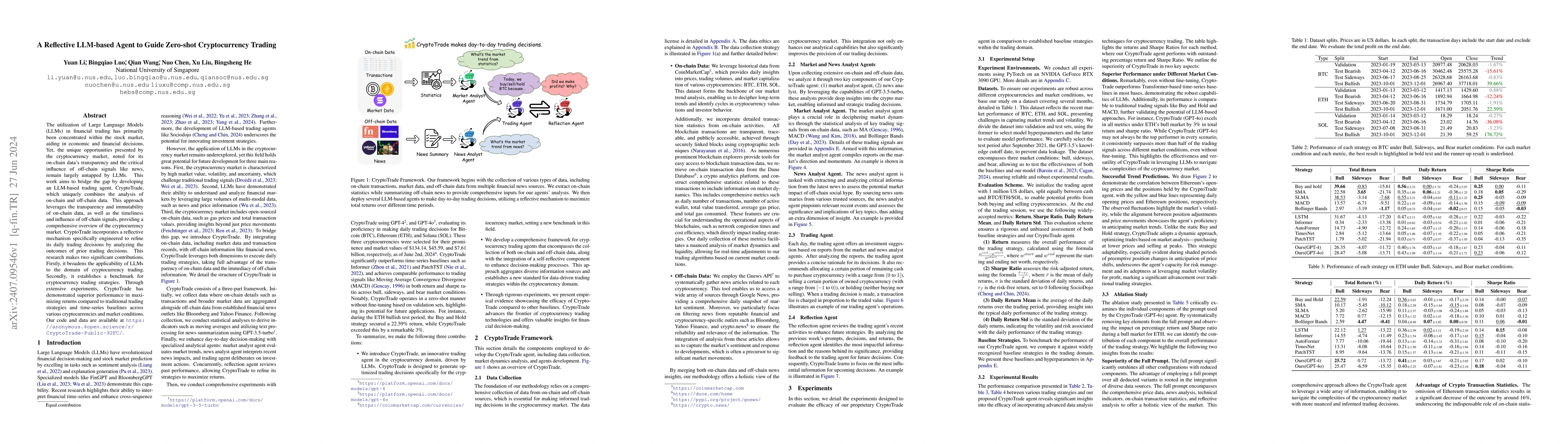

The utilization of Large Language Models (LLMs) in financial trading has primarily been concentrated within the stock market, aiding in economic and financial decisions. Yet, the unique opportunities presented by the cryptocurrency market, noted for its on-chain data's transparency and the critical influence of off-chain signals like news, remain largely untapped by LLMs. This work aims to bridge the gap by developing an LLM-based trading agent, CryptoTrade, which uniquely combines the analysis of on-chain and off-chain data. This approach leverages the transparency and immutability of on-chain data, as well as the timeliness and influence of off-chain signals, providing a comprehensive overview of the cryptocurrency market. CryptoTrade incorporates a reflective mechanism specifically engineered to refine its daily trading decisions by analyzing the outcomes of prior trading decisions. This research makes two significant contributions. Firstly, it broadens the applicability of LLMs to the domain of cryptocurrency trading. Secondly, it establishes a benchmark for cryptocurrency trading strategies. Through extensive experiments, CryptoTrade has demonstrated superior performance in maximizing returns compared to traditional trading strategies and time-series baselines across various cryptocurrencies and market conditions. Our code and data are available at \url{https://anonymous.4open.science/r/CryptoTrade-Public-92FC/}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCryptocurrency Trading: A Comprehensive Survey

Lingbo Li, Fan Wu, Carmine Ventre et al.

MountainLion: A Multi-Modal LLM-Based Agent System for Interpretable and Adaptive Financial Trading

Tianyu Shi, Hanlin Zhang, Yi Xin et al.

Agent-Based Genetic Algorithm for Crypto Trading Strategy Optimization

Qiushi Tian, Runnan Li, Churong Liang et al.

PulseReddit: A Novel Reddit Dataset for Benchmarking MAS in High-Frequency Cryptocurrency Trading

Qian Wang, Atsushi Yoshikawa, Qiuhan Han et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)