Authors

Summary

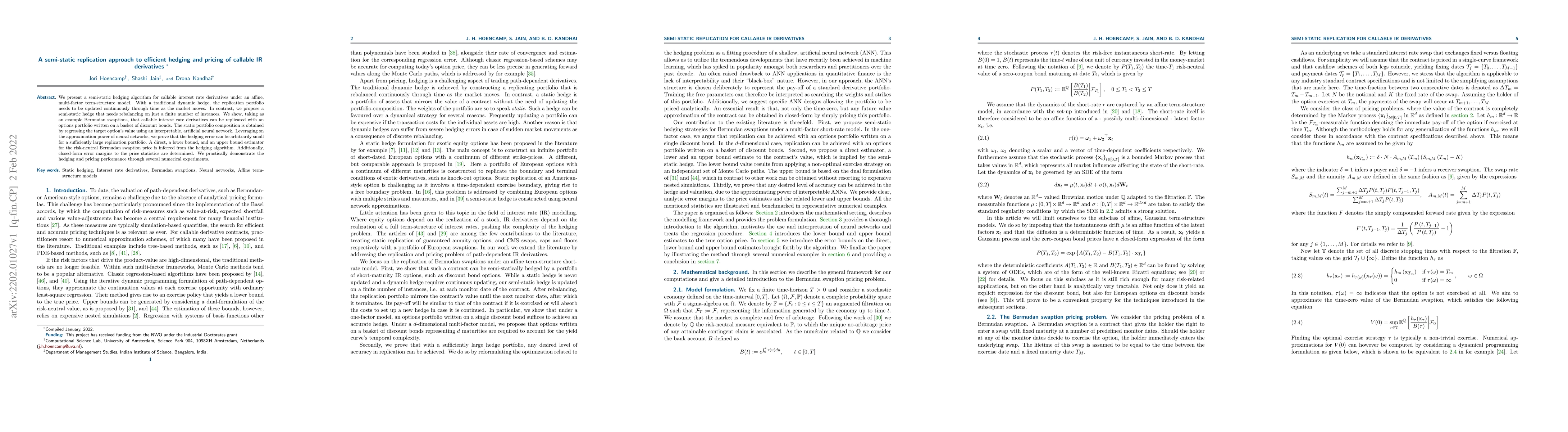

We present a semi-static hedging algorithm for callable interest rate derivatives under an affine, multi-factor term-structure model. With a traditional dynamic hedge, the replication portfolio needs to be updated continuously through time as the market moves. In contrast, we propose a semi-static hedge that needs rebalancing on just a finite number of instances. We show, taking as an example Bermudan swaptions, that callable interest rate derivatives can be replicated with an options portfolio written on a basket of discount bonds. The static portfolio composition is obtained by regressing the target option's value using an interpretable, artificial neural network. Leveraging on the approximation power of neural networks, we prove that the hedging error can be arbitrarily small for a sufficiently large replication portfolio. A direct, a lower bound, and an upper bound estimator for the risk-neutral Bermudan swaption price is inferred from the hedging algorithm. Additionally, closed-form error margins to the price statistics are determined. We practically demonstrate the hedging and pricing performance through several numerical experiments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)