Summary

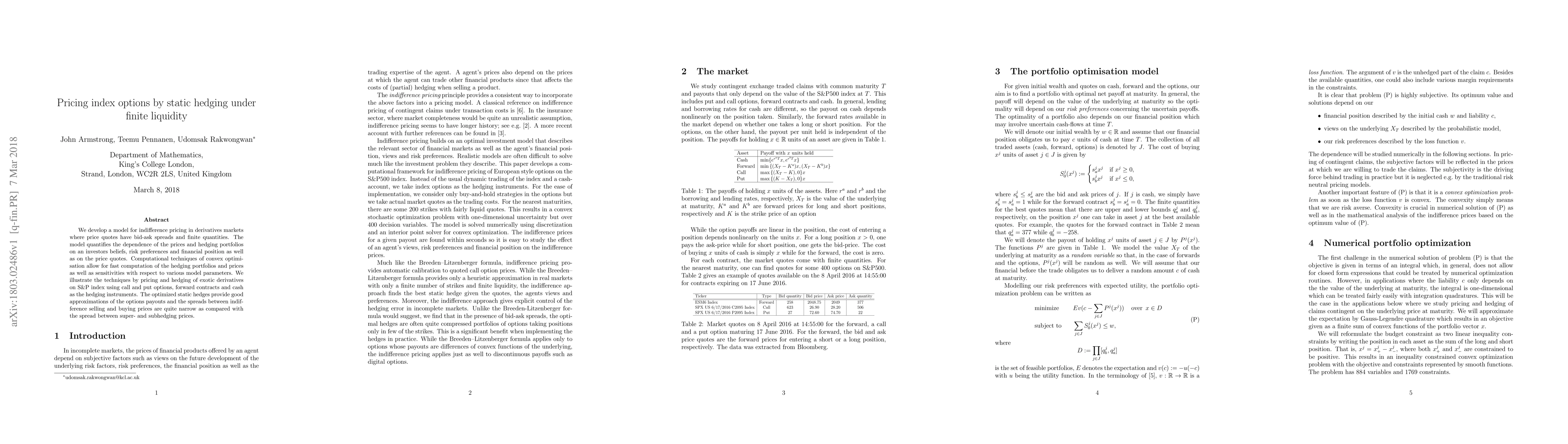

We develop a model for indifference pricing in derivatives markets where price quotes have bid-ask spreads and finite quantities. The model quantifies the dependence of the prices and hedging portfolios on an investor's beliefs, risk preferences and financial position as well as on the price quotes. Computational techniques of convex optimisation allow for fast computation of the hedging portfolios and prices as well as sensitivities with respect to various model parameters. We illustrate the techniques by pricing and hedging of exotic derivatives on S&P index using call and put options, forward contracts and cash as the hedging instruments. The optimized static hedges provide good approximations of the options payouts and the spreads between indifference selling and buying prices are quite narrow as compared with the spread between super- and subhedging prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)