Summary

We study the problem of optimal pricing and hedging of a European option written on an illiquid asset $Z$ using a set of proxies: a liquid asset $S$, and $N$ liquid European options $P_i$, each written on a liquid asset $Y_i, i=1,N$. We assume that the $S$-hedge is dynamic while the multi-name $Y$-hedge is static. Using the indifference pricing approach with an exponential utility, we derive a HJB equation for the value function, and build an efficient numerical algorithm. The latter is based on several changes of variables, a splitting scheme, and a set of Fast Gauss Transforms (FGT), which turns out to be more efficient in terms of complexity and lower local space error than a finite-difference method. While in this paper we apply our framework to an incomplete market version of the credit-equity Merton's model, the same approach can be used for other asset classes (equity, commodity, FX, etc.), e.g. for pricing and hedging options with illiquid strikes or illiquid exotic options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

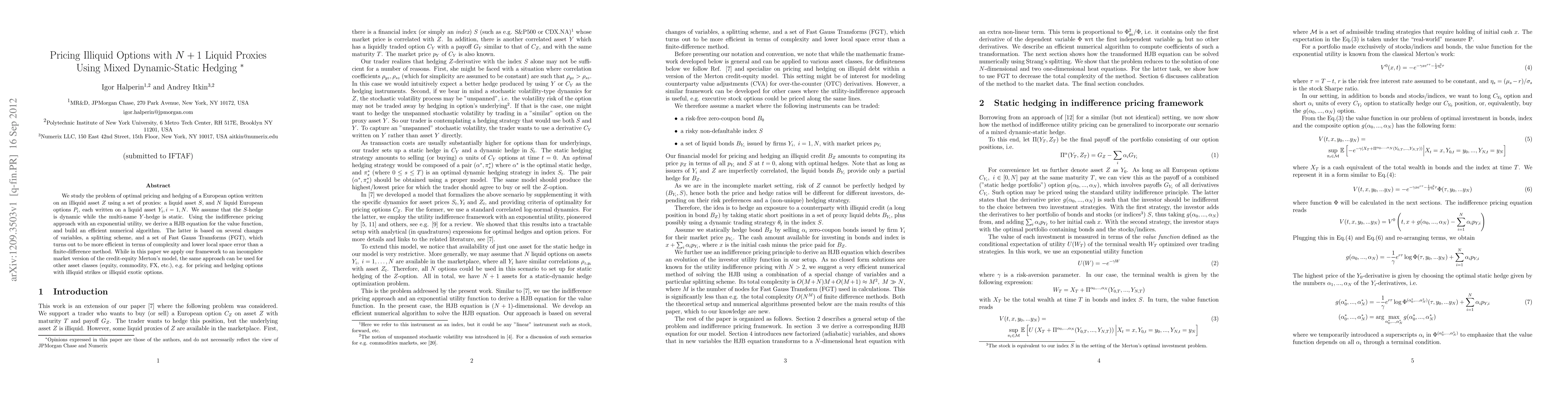

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)