Summary

This work addresses the problem of optimal pricing and hedging of a European option on an illiquid asset Z using two proxies: a liquid asset S and a liquid European option on another liquid asset Y. We assume that the S-hedge is dynamic while the Y-hedge is static. Using the indifference pricing approach we derive a HJB equation for the value function, and solve it analytically (in quadratures) using an asymptotic expansion around the limit of the perfect correlation between assets Y and Z. While in this paper we apply our framework to an incomplete market version of the credit-equity Merton's model, the same approach can be used for other asset classes (equity, commodity, FX, etc.), e.g. for pricing and hedging options with illiquid strikes or illiquid exotic options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

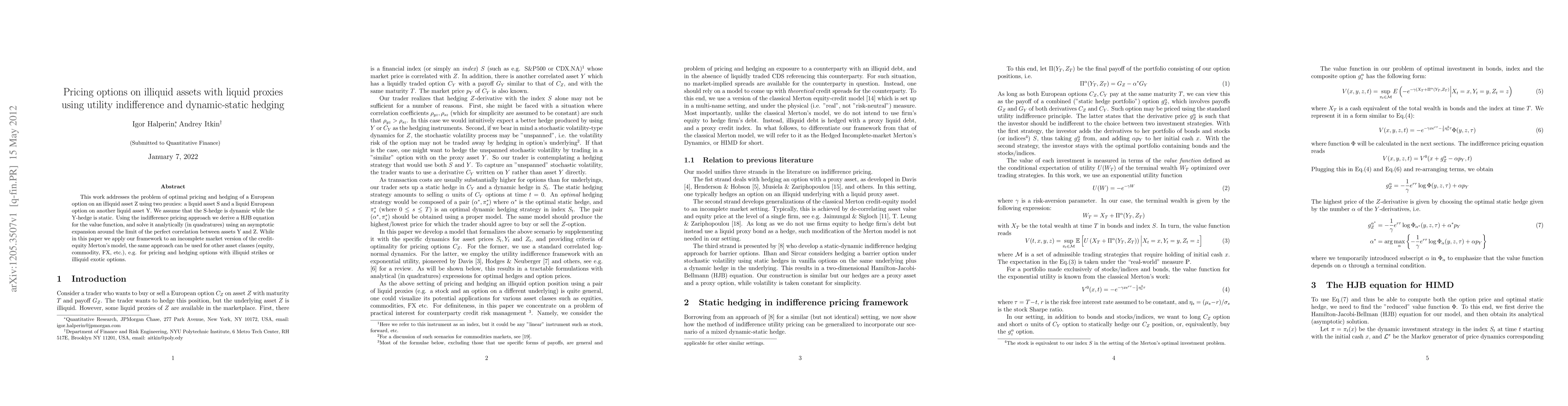

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)