Summary

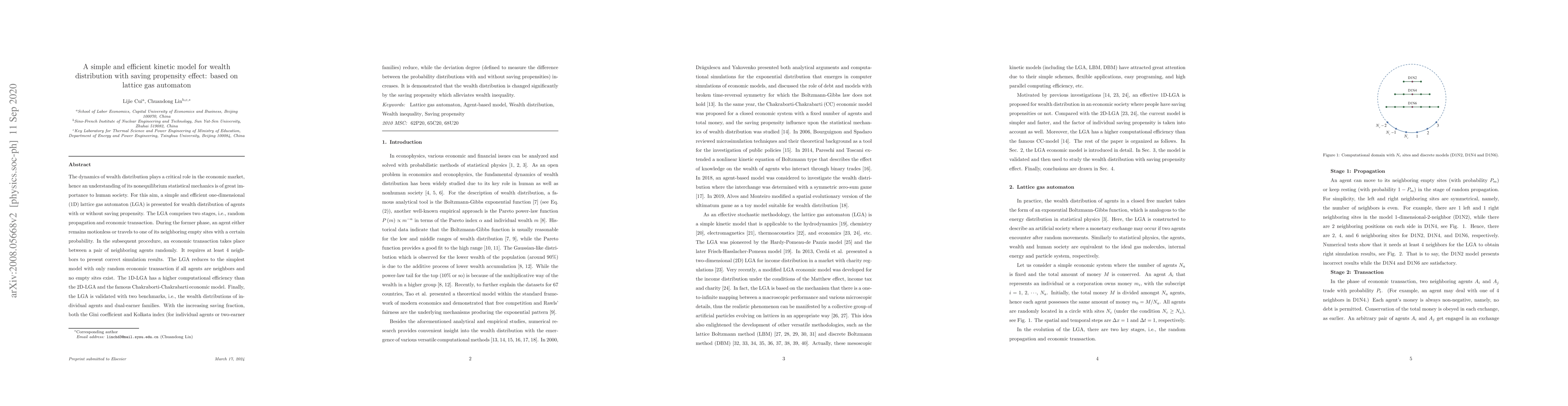

The dynamics of wealth distribution plays a critical role in the economic market, hence an understanding of its nonequilibrium statistical mechanics is of great importance to human society. For this aim, a simple and efficient one-dimensional (1D) lattice gas automaton (LGA) is presented for wealth distribution of agents with or without saving propensity. The LGA comprises two stages, i.e., random propagation and economic transaction. During the former phase, an agent either remains motionless or travels to one of its neighboring empty sites with a certain probability. In the subsequent procedure, an economic transaction takes place between a pair of neighboring agents randomly. It requires at least 4 neighbors to present correct simulation results. The LGA reduces to the simplest model with only random economic transaction if all agents are neighbors and no empty sites exist. The 1D-LGA has a higher computational efficiency than the 2D-LGA and the famous Chakraborti-Chakrabarti economic model. Finally, the LGA is validated with two benchmarks, i.e., the wealth distributions of individual agents and dual-earner families. With the increasing saving fraction, both the Gini coefficient and Kolkata index (for individual agents or two-earner families) reduce, while the deviation degree (defined to measure the difference between the probability distributions with and without saving propensities) increases. It is demonstrated that the wealth distribution is changed significantly by the saving propensity which alleviates wealth inequality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInfluence of saving propensity on the power law tail of wealth distribution

Marco Patriarca, Anirban Chakraborti, Guido Germano

Variation of Gini and Kolkata Indices with Saving Propensity in the Kinetic Exchange Model of Wealth Distribution: An Analytical Study

Bikas K. Chakrabarti, Bijin Joseph

| Title | Authors | Year | Actions |

|---|

Comments (0)