Summary

We develop a continuous-time stochastic model for optimal cybersecurity investment under the threat of cyberattacks. The arrival of attacks is modeled using a Hawkes process, capturing the empirically relevant feature of clustering in cyberattacks. Extending the Gordon-Loeb model, each attack may result in a breach, with breach probability depending on the system's vulnerability. We aim at determining the optimal cybersecurity investment to reduce vulnerability. The problem is cast as a two-dimensional Markovian stochastic optimal control problem and solved using dynamic programming methods. Numerical results illustrate how accounting for attack clustering leads to more responsive and effective investment policies, offering significant improvements over static and Poisson-based benchmark strategies. Our findings underscore the value of incorporating realistic threat dynamics into cybersecurity risk management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

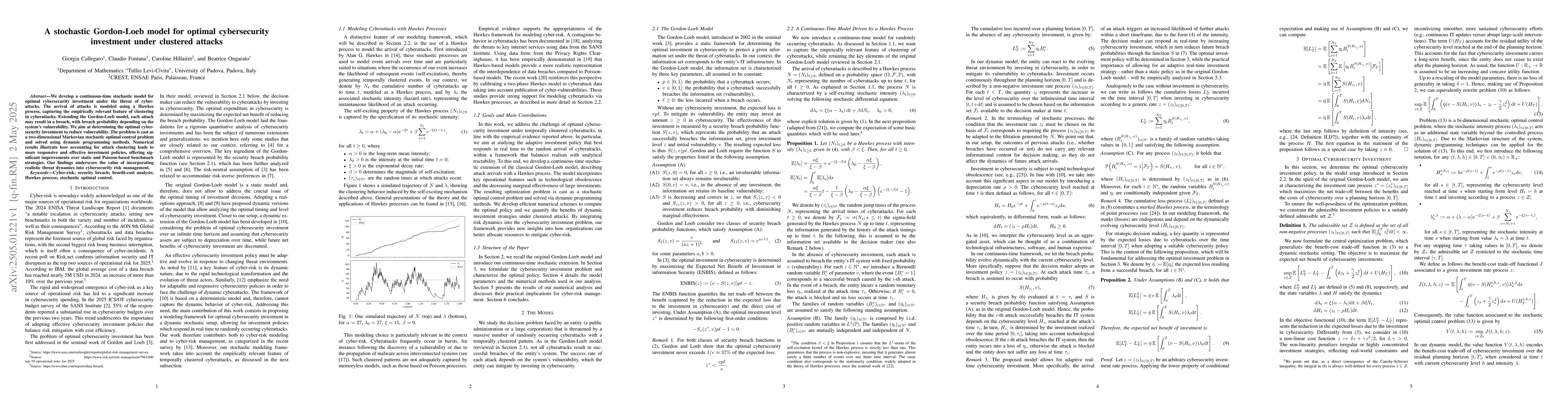

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEconomics and Optimal Investment Policies of Attackers and Defenders in Cybersecurity

Debasis Mitra, Austin Ebel

No citations found for this paper.

Comments (0)