Summary

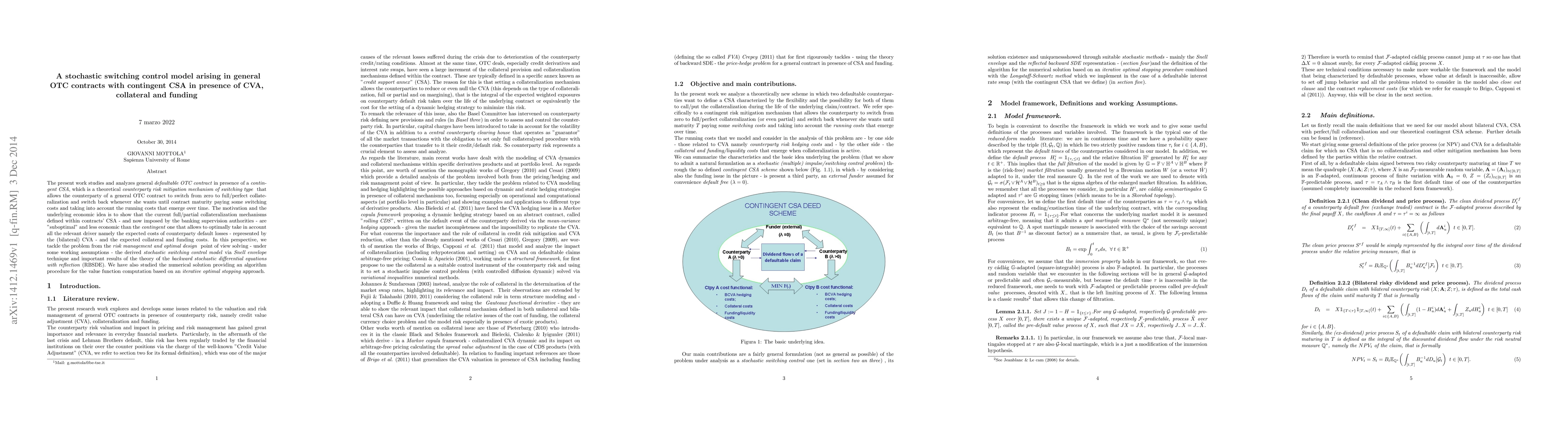

The present work studies and analyzes general defaultable OTC contract in presence of a contingent CSA, which is a theoretical counterparty risk mitigation mechanism of switching type that allows the counterparty of a general OTC contract to switch from zero to full/perfect collateralization and switch back whenever she wants until contract maturity paying some switching costs and taking into account the running costs that emerge over time. The motivation and the underlying economic idea is to show that the current full/partial collateralization mechanisms defined within contracts' CSA - and now imposed by the banking supervision authorities - are "suboptimal" and less economic than the contingent one that allows to optimally take in account all the relevant driver namely the expected costs of counterparty default losses - represented by the (bilateral) CVA - and the expected collateral and funding costs. In this perspective, we tackle the problem from the risk management and optimal design point of view solving - under some working assumptions - the derived stochastic switching control model via Snell envelope technique and important results of the theory of the backward stochastic differential equations with reflection (RBSDE). We have also studied the numerical solution providing an algorithm procedure for the value function computation based on an iterative optimal stopping approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)