Summary

In this work we study the price-hedge issue for general defaultable contracts characterized by the presence of a contingent CSA of switching type. This is a contingent risk mitigation mechanism that allow the counterparties of a defaultable contract to switch from zero to full/perfect collateralization and switch back whenever until maturity T paying some instantaneous switching costs , taking in account in the picture CVA, collateralization and the funding problem. We have been lead to the study of this theoretical pricing/hedging problem, by the economic significance of this type of mechanism which allows a greater flexibility in managing all the defaultable contract risks with respect to the "standard" non contingent mitigation mechanisms (as full or partial collateralization). In particular, our approach through hedging strategy decomposition of the claim (proposition 2.2.5) and its price-hedge representation through system of nonlinear reflected BSDE (theorem 3.2.4) are the main contribution of the work.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

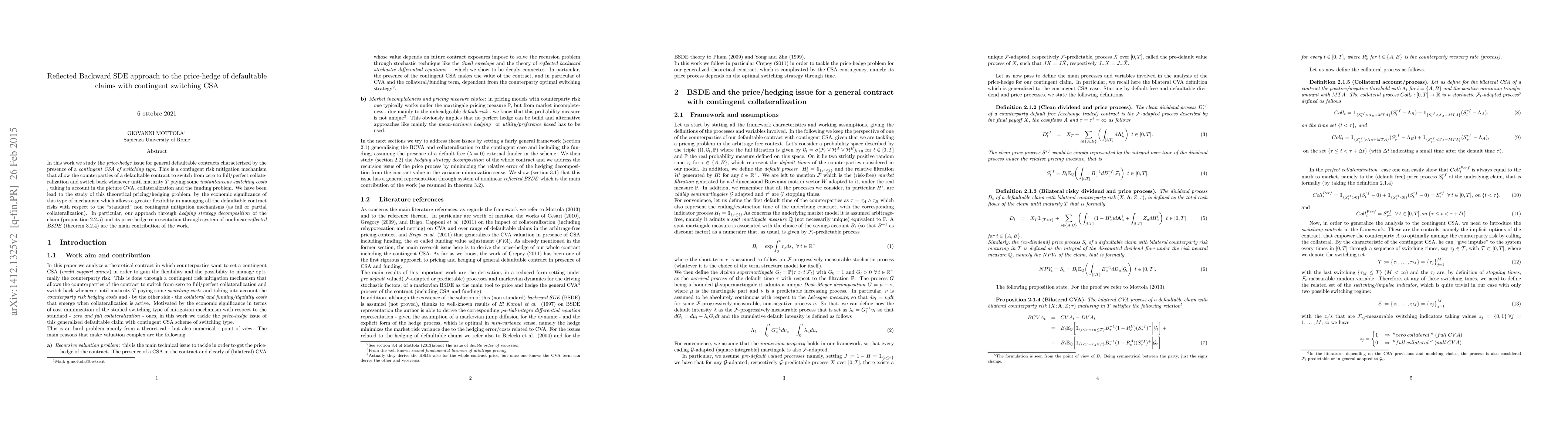

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)