Summary

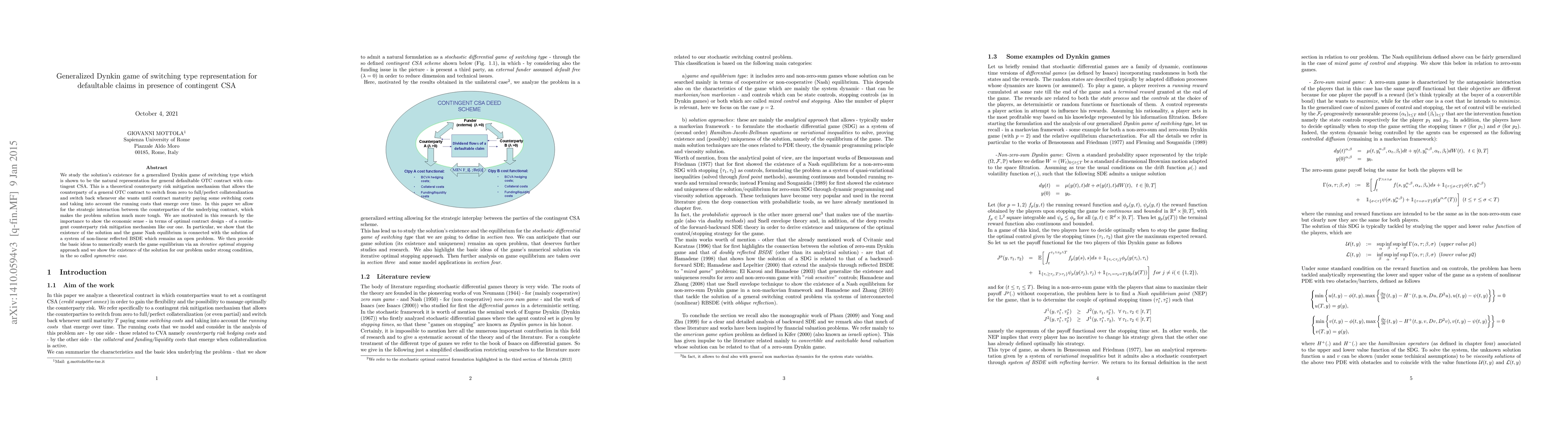

We study the solution's existence for a generalized Dynkin game of switching type which is shown to be the natural representation for general defaultable OTC contract with contingent CSA. This is a theoretical counterparty risk mitigation mechanism that allows the counterparty of a general OTC contract to switch from zero to full/perfect collateralization and switch back whenever she wants until contract maturity paying some switching costs and taking into account the running costs that emerge over time. In this paper we allow for the strategic interaction between the counterparties of the underlying contract, which makes the problem solution much more tough. We are motivated in this research by the importance to show the economic sense - in terms of optimal contract design - of a contingent counterparty risk mitigation mechanism like our one. In particular, we show that the existence of the solution and the game Nash equilibrium is connected with the solution of a system of non-linear reflected BSDE which remains an open problem. We then provide the basic ideas to numerically search the game equilibrium via an iterative optimal stopping approach and we show the existence of the solution for our problem under strong condition, in the so called symmetric case.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)