Authors

Summary

We consider a tick-by-tick model of price formation, in which buy and sell orders are modeled as self-exciting point processes (Hawkes process), similar to the one in [El Euch, Fukasawa, Rosenbaum, The microstructural foundations of leverage effect and rough volatility, Finance and Stochastics, 2018]. We adopt an agent based approach by studying the aggregation of a large number of these point processes, mutually interacting in a mean-field sense. The financial interpretation is that of an asset on which several labeled agents place buy and sell orders following these point processes, influencing the price. The mean-field interaction introduces positive correlations between order volumes coming from different agents that reflect features of real markets such as herd behavior and contagion. When the large scale limit of the aggregated asset price is computed, if parameters are set to a critical value, a singular phenomenon occurs: the aggregated model converges to a stochastic volatility model with leverage effect and faster-than-linear mean reversion of the volatility process. The faster-than-linear mean reversion of the volatility process is supported by econometric evidence, and we have linked it in [Dai Pra, Pigato, Multi-scaling of moments in stochastic volatility models, Stochastic Processes and their Applications, 2015] to the observed multifractal behavior of assets prices and market indices. This seems connected to the Statistical Physics perspective that expects anomalous scaling properties to arise in the critical regime.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a tick-by-tick model of price formation using self-exciting point processes (Hawkes process) and an agent-based approach to study the aggregation of multiple point processes with mean-field interaction, reflecting market features like herd behavior and contagion.

Key Results

- When parameters are set to a critical value, the aggregated model converges to a stochastic volatility model with leverage effect.

- The volatility process exhibits faster-than-linear mean reversion, supported by econometric evidence.

- This faster-than-linear mean reversion links to the multifractal behavior of asset prices and market indices.

Significance

This research is important as it bridges financial modeling with statistical physics, providing insights into real market phenomena like herd behavior and contagion, and offering a novel stochastic volatility model with implications for risk management and trading strategies.

Technical Contribution

The paper introduces a stochastic volatility approximation for a tick-by-tick price model with mean-field interaction, demonstrating a critical parameter regime that leads to a model with leverage effect and faster-than-linear mean reversion of volatility.

Novelty

This work stands out by linking mean-field interaction in agent-based models to stochastic volatility models, revealing a critical regime where faster-than-linear mean reversion emerges, supported by econometric evidence and connected to multifractal price behavior.

Limitations

- The model assumes labeled agents, which may not fully capture the anonymity of real market participants.

- The study is based on specific parameter settings and critical values; generalizability to other market conditions might be limited.

Future Work

- Investigate the model's applicability to various financial instruments and market conditions.

- Explore extensions to incorporate more complex market microstructure features.

Paper Details

PDF Preview

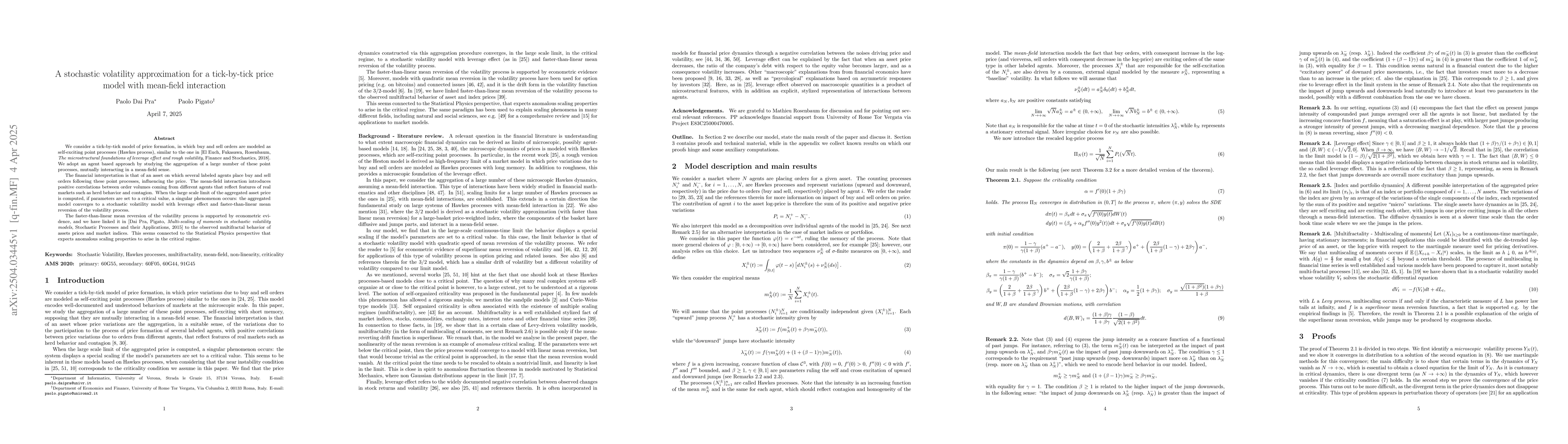

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo Tick-Size Too Small: A General Method for Modelling Small Tick Limit Order Books

Emmanuel Bacry, Konark Jain, Jonathan Kochems et al.

No citations found for this paper.

Comments (0)