Authors

Summary

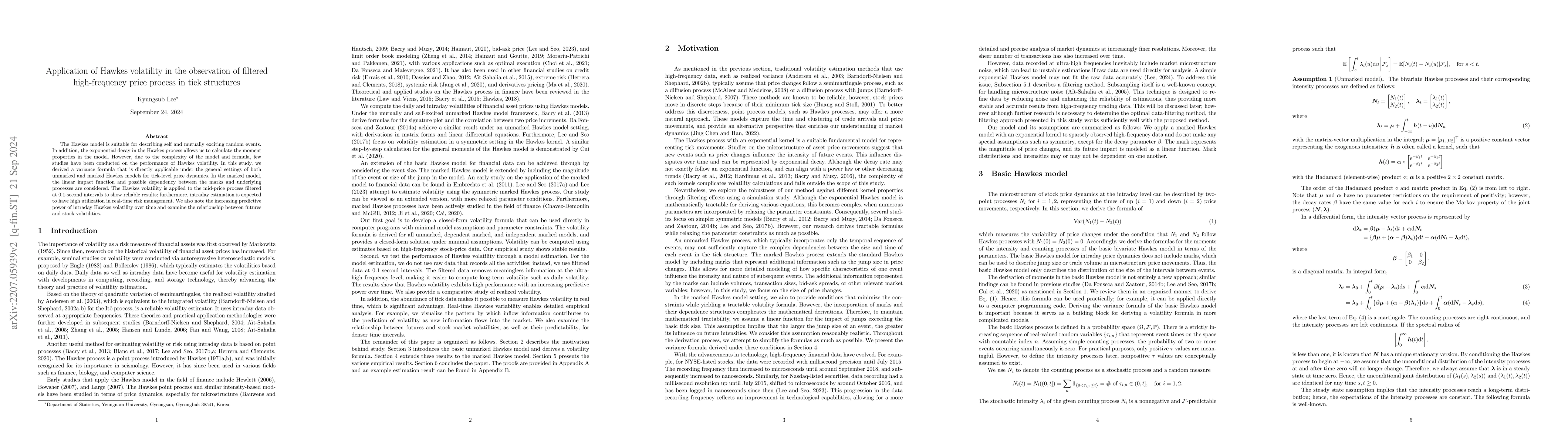

The Hawkes model is suitable for describing self and mutually exciting random events. In addition, the exponential decay in the Hawkes process allows us to calculate the moment properties in the model. However, due to the complexity of the model and formula, few studies have been conducted on the performance of Hawkes volatility. In this study, we derived a variance formula that is directly applicable under the general settings of both unmarked and marked Hawkes models for tick-level price dynamics. In the marked model, the linear impact function and possible dependency between the marks and underlying processes are considered. The Hawkes volatility is applied to the mid-price process filtered at 0.1-second intervals to show reliable results; furthermore, intraday estimation is expected to have high utilization in real-time risk management. We also note the increasing predictive power of intraday Hawkes volatility over time and examine the relationship between futures and stock volatilities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)