Authors

Summary

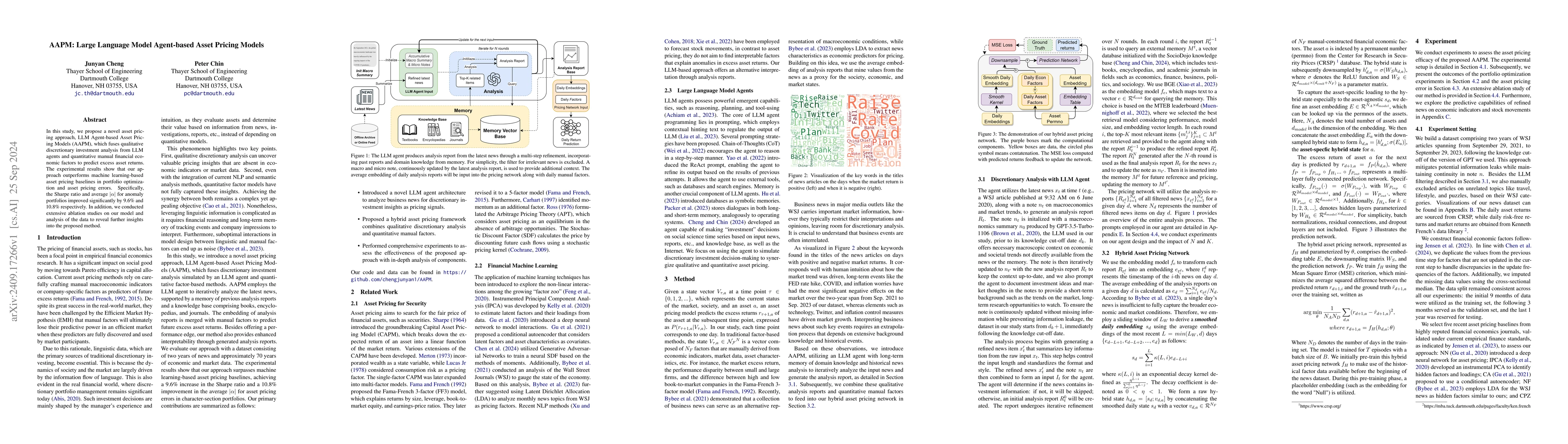

In this study, we propose a novel asset pricing approach, LLM Agent-based Asset Pricing Models (AAPM), which fuses qualitative discretionary investment analysis from LLM agents and quantitative manual financial economic factors to predict excess asset returns. The experimental results show that our approach outperforms machine learning-based asset pricing baselines in portfolio optimization and asset pricing errors. Specifically, the Sharpe ratio and average $|\alpha|$ for anomaly portfolios improved significantly by 9.6\% and 10.8\% respectively. In addition, we conducted extensive ablation studies on our model and analysis of the data to reveal further insights into the proposed method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)