Summary

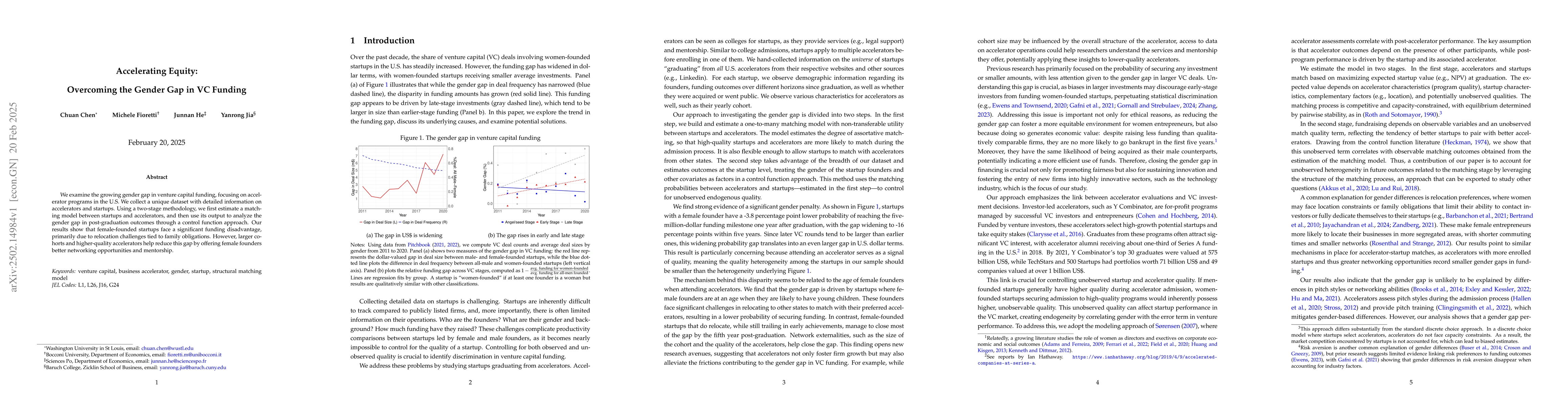

We examine the growing gender gap in venture capital funding, focusing on accelerator programs in the U.S. We collect a unique dataset with detailed information on accelerators and startups. Using a two-stage methodology, we first estimate a matching model between startups and accelerators, and then use its output to analyze the gender gap in post-graduation outcomes through a control function approach. Our results show that female-founded startups face a significant funding disadvantage, primarily due to relocation challenges tied to family obligations. However, larger cohorts and higher-quality accelerators help reduce this gap by offering female founders better networking opportunities and mentorship.

AI Key Findings

Generated Jun 11, 2025

Methodology

This study uses a two-stage methodology, combining a matching model between startups and accelerators with a control function approach to analyze the gender gap in post-graduation outcomes, accounting for endogenous factors affecting venture outcomes.

Key Results

- Female-founded startups face a significant funding disadvantage, primarily due to relocation challenges tied to family obligations.

- Larger cohorts and higher-quality accelerators help reduce the gender gap by offering female founders better networking opportunities and mentorship.

- Female founders have similar survival and successful exit rates as other startups, despite receiving less funding, indicating their high productivity.

- The gender gap in funding disappears over the five-year horizon for startups in more experienced accelerators, suggesting tailored mentorship programs.

- Startups founded by women are not significantly more likely to fail within the first year or five years, and they are equally likely to be acquired or go public within five years.

Significance

Understanding and mitigating the gender gap in venture capital funding is crucial for fairness and maximizing the economic potential of women entrepreneurs.

Technical Contribution

The paper combines a one-to-many matching model with non-transferable utility and a control function approach to estimate startup outcomes, providing a nuanced understanding of the gender funding gap in venture capital.

Novelty

This research offers a unique perspective by focusing on accelerator programs and their role in mitigating the gender gap in venture capital funding, providing empirical evidence on the impact of accelerator quality and cohort size on female founders' outcomes.

Limitations

- The study is limited by the availability of reliable revenue and employment data for assessing startup productivity.

- Smaller sample sizes for certain analyses may lead to larger standard errors and reduced statistical power.

- The research focuses on U.S. accelerator graduates, which may limit the generalizability of findings to other regions or types of funding.

Future Work

- Further research could explore the specific programs and interactions within accelerators that help reduce the gender gap in funding.

- Investigating the effectiveness of policies aimed at reducing the gender gap in financing and their broader societal impacts.

- Expanding the dataset to include more diverse geographical and industry contexts to enhance the generalizability of findings.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSynthetic forwards and cost of funding in the equity derivative market

Michele Azzone, Roberto Baviera

No citations found for this paper.

Comments (0)