Summary

Valuation adjustments are nowadays a common practice to include credit and liquidity effects in option pricing. Funding costs arising from collateral procedures, hedging strategies and taxes are added to option prices to take into account the production cost of financial contracts so that a profitability analysis can be reliably assessed. In particular, when dealing with linear products, we need a precise evaluation of such contributions since bid-ask spreads may be very tight. In this paper we start from a general pricing framework inclusive of valuation adjustments to derive simple evaluation formulae for the relevant case of total return equity swaps when stock lending and borrowing is adopted as hedging strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

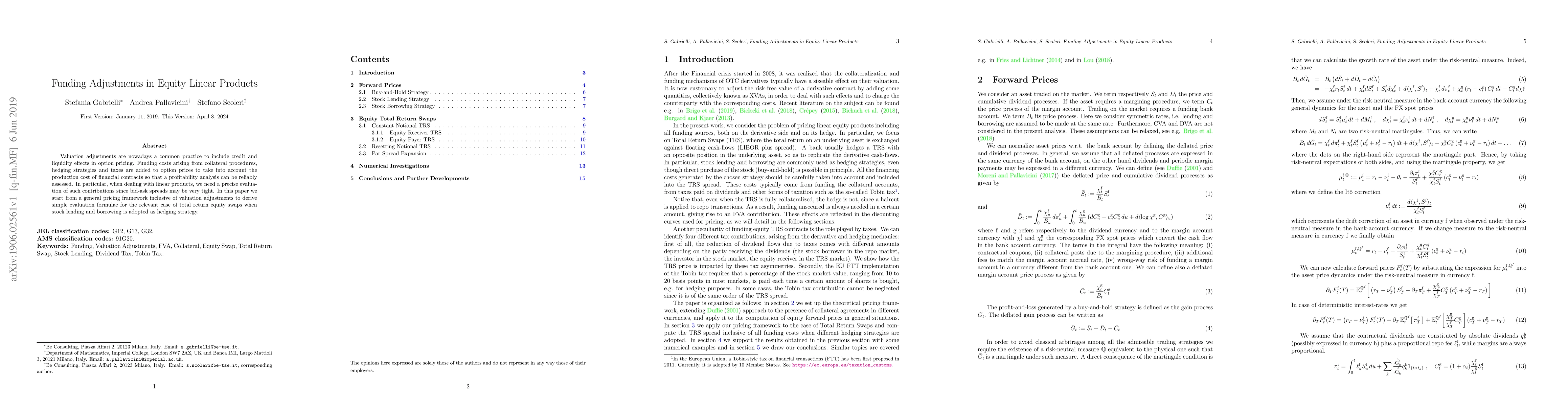

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRelevance of Wrong-Way Risk in Funding Valuation Adjustments

T. van der Zwaard, L. A. Grzelak, C. W. Oosterlee

Synthetic forwards and cost of funding in the equity derivative market

Michele Azzone, Roberto Baviera

| Title | Authors | Year | Actions |

|---|

Comments (0)