Authors

Summary

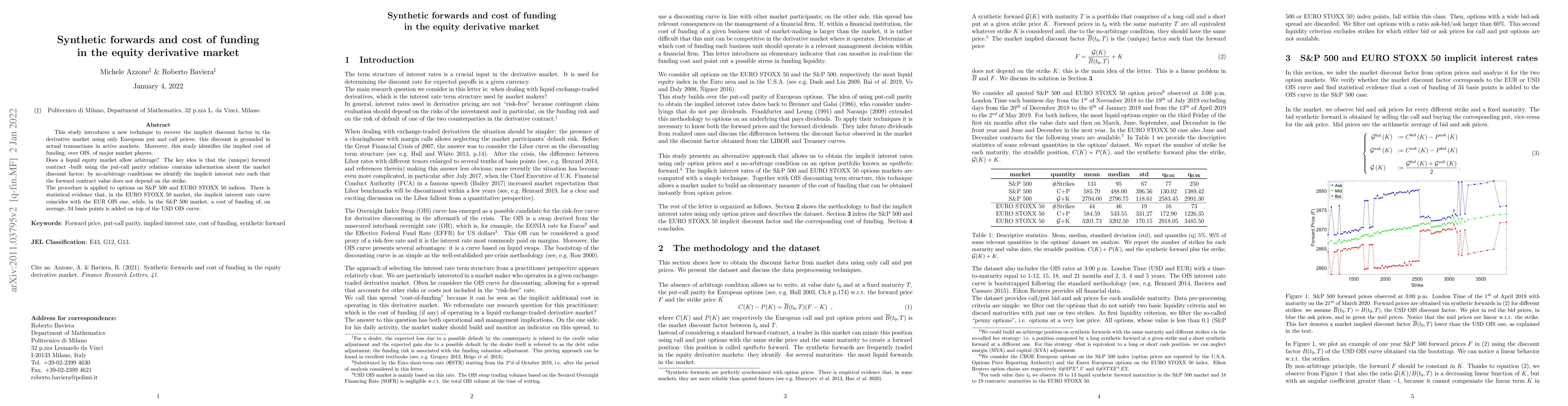

This study introduces a new technique to recover the implicit discount factor in the derivative market using only European put and call prices: this discount is grounded in actual transactions in active markets. Moreover, this study identifies the implied cost of funding, over OIS, of major market players. Does a liquid equity market allow arbitrage? The key idea is that the (unique) forward contract -- built using the put-call parity relation -- contains information about the market discount factor: by no-arbitrage conditions we identify the implicit interest rate such that the forward contract value does not depend on the strike. The procedure is applied to options on S&P 500 and EURO STOXX 50 indices. There is statistical evidence that, in the EURO STOXX 50 market, the implicit interest rate curve coincides with the EUR OIS one, while, in the S&P 500 market, a cost of funding of, on average, 34 basis points is added on top of the USD OIS curve.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFunding advantage and market discipline in the Canadian banking sector

Mehdi Beyhaghi, Chris D'Souza, Gordon S. Roberts

Analytical valuation of vulnerable derivative claims with bilateral cash flows under credit, funding and wrong-way risk

Juan Jose Francisco Miguelez, Cristin Buescu

| Title | Authors | Year | Actions |

|---|

Comments (0)