Summary

Standard methods, such as sequential procedures based on Johansen's (pseudo-)likelihood ratio (PLR) test, for determining the co-integration rank of a vector autoregressive (VAR) system of variables integrated of order one can be significantly affected, even asymptotically, by unconditional heteroskedasticity (non-stationary volatility) in the data. Known solutions to this problem include wild bootstrap implementations of the PLR test or the use of an information criterion, such as the BIC, to select the co-integration rank. Although asymptotically valid in the presence of heteroskedasticity, these methods can display very low finite sample power under some patterns of non-stationary volatility. In particular, they do not exploit potential efficiency gains that could be realised in the presence of non-stationary volatility by using adaptive inference methods. Under the assumption of a known autoregressive lag length, Boswijk and Zu (2022) develop adaptive PLR test based methods using a non-parameteric estimate of the covariance matrix process. It is well-known, however, that selecting an incorrect lag length can significantly impact on the efficacy of both information criteria and bootstrap PLR tests to determine co-integration rank in finite samples. We show that adaptive information criteria-based approaches can be used to estimate the autoregressive lag order to use in connection with bootstrap adaptive PLR tests, or to jointly determine the co-integration rank and the VAR lag length and that in both cases they are weakly consistent for these parameters in the presence of non-stationary volatility provided standard conditions hold on the penalty term. Monte Carlo simulations are used to demonstrate the potential gains from using adaptive methods and an empirical application to the U.S. term structure is provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

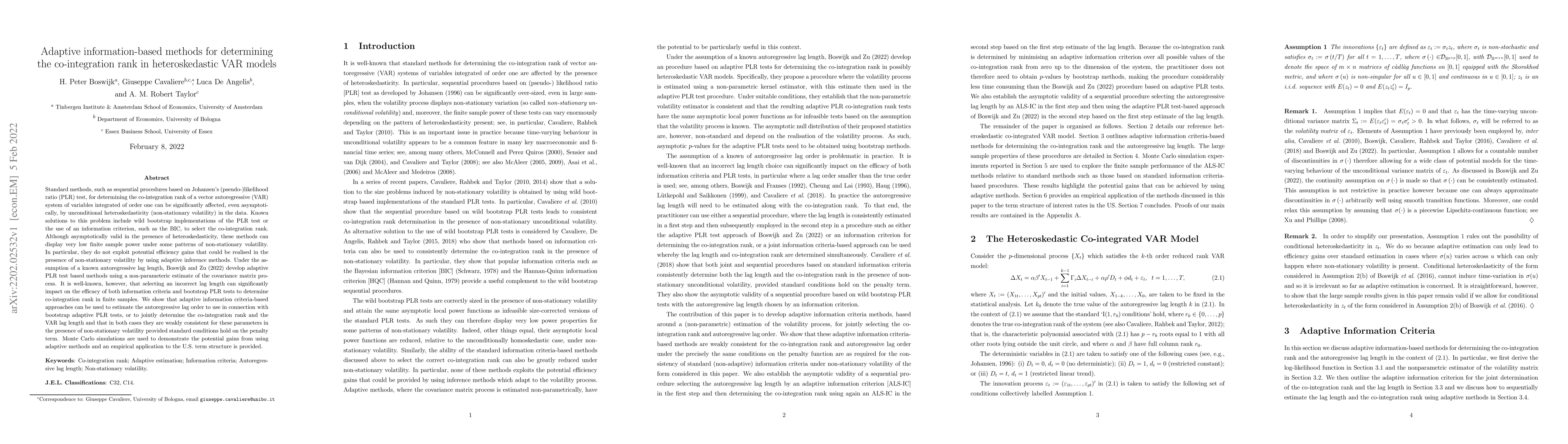

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChange point detection in low-rank VAR processes

Olga Klopp, Farida Enikeeva, Mathilde Rousselot

| Title | Authors | Year | Actions |

|---|

Comments (0)