Authors

Summary

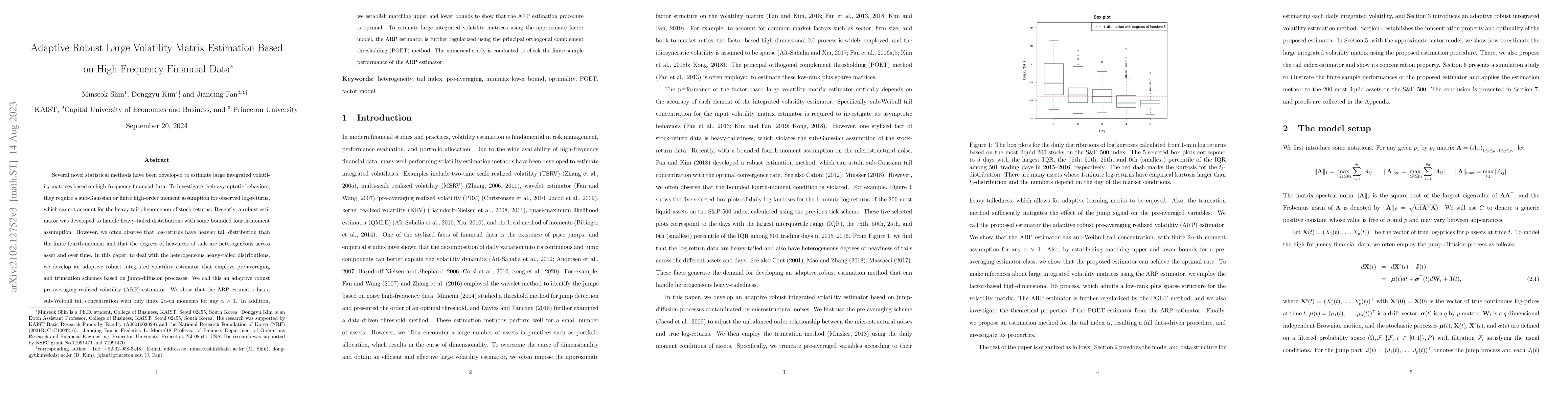

Several novel statistical methods have been developed to estimate large integrated volatility matrices based on high-frequency financial data. To investigate their asymptotic behaviors, they require a sub-Gaussian or finite high-order moment assumption for observed log-returns, which cannot account for the heavy-tail phenomenon of stock-returns. Recently, a robust estimator was developed to handle heavy-tailed distributions with some bounded fourth-moment assumption. However, we often observe that log-returns have heavier tail distribution than the finite fourth-moment and that the degrees of heaviness of tails are heterogeneous across asset and over time. In this paper, to deal with the heterogeneous heavy-tailed distributions, we develop an adaptive robust integrated volatility estimator that employs pre-averaging and truncation schemes based on jump-diffusion processes. We call this an adaptive robust pre-averaging realized volatility (ARP) estimator. We show that the ARP estimator has a sub-Weibull tail concentration with only finite 2$\alpha$-th moments for any $\alpha>1$. In addition, we establish matching upper and lower bounds to show that the ARP estimation procedure is optimal. To estimate large integrated volatility matrices using the approximate factor model, the ARP estimator is further regularized using the principal orthogonal complement thresholding (POET) method. The numerical study is conducted to check the finite sample performance of the ARP estimator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNonparametric Estimation of Large Spot Volatility Matrices for High-Frequency Financial Data

Oliver Linton, Hanchao Wang, Degui Li et al.

Cubic-based Prediction Approach for Large Volatility Matrix using High-Frequency Financial Data

Donggyu Kim, Sung Hoon Choi

| Title | Authors | Year | Actions |

|---|

Comments (0)