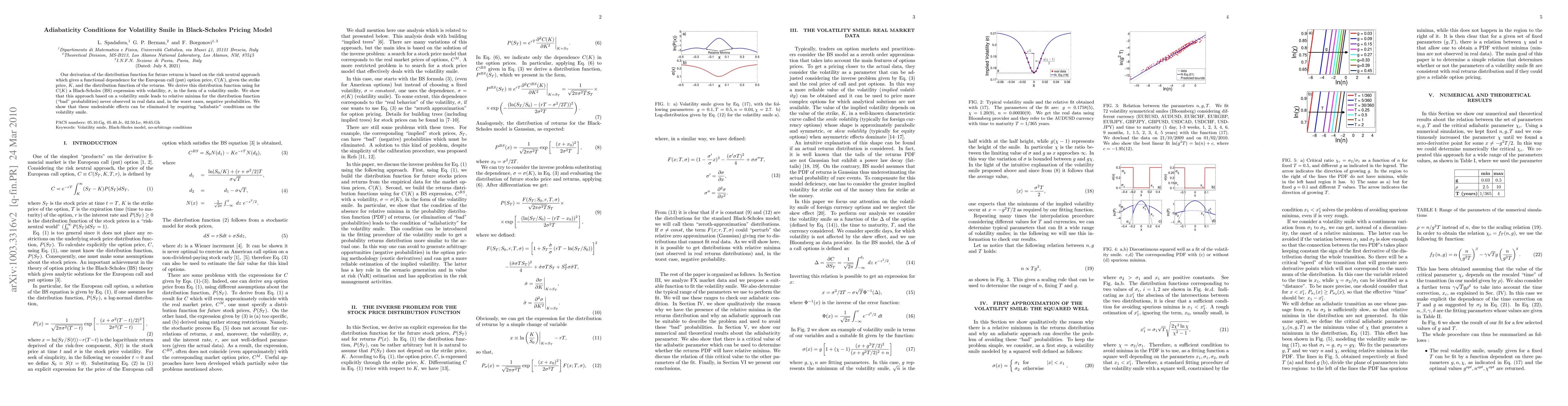

Summary

Our derivation of the distribution function for future returns is based on the risk neutral approach which gives a functional dependence for the European call (put) option price, C(K), given the strike price, K, and the distribution function of the returns. We derive this distribution function using for C(K) a Black-Scholes (BS) expression with volatility in the form of a volatility smile. We show that this approach based on a volatility smile leads to relative minima for the distribution function ("bad" probabilities) never observed in real data and, in the worst cases, negative probabilities. We show that these undesirable effects can be eliminated by requiring "adiabatic" conditions on the volatility smile.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)