Authors

Summary

We observe that a European Call option with strike $L > K$ can be seen as a Call option with strike $L-K$ on a Call option with strike $K$. Under no arbitrage assumptions, this yields immediately that the prices of the two contracts are the same, in full generality. We study in detail the relative pricing function which gives the price of the Call on Call option as a function of its underlying Call option, and provide quasi-closed formula for those new pricing functions in the Carr-Pelts-Tehranchi family [Carr and Pelts, Duality, Deltas, and Derivatives Pricing, 2015] and [Tehranchi, A Black-Scholes inequality: applications and generalisations, Finance Stoch, 2020] that includes the Black-Scholes model as a particular case. We also study the properties of the function that maps the price normalized by the underlier, viewed as a function of the moneyness, to the normalized relative price, which allows us to produce several new closed formulas. In connection to the symmetry transformation of a smile, we build a lift of the relative pricing function in the case of an underlier that does not vanish. We finally provide some properties of the implied volatility smiles of Calls on Calls and lifted Calls on Calls in the Black-Scholes model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

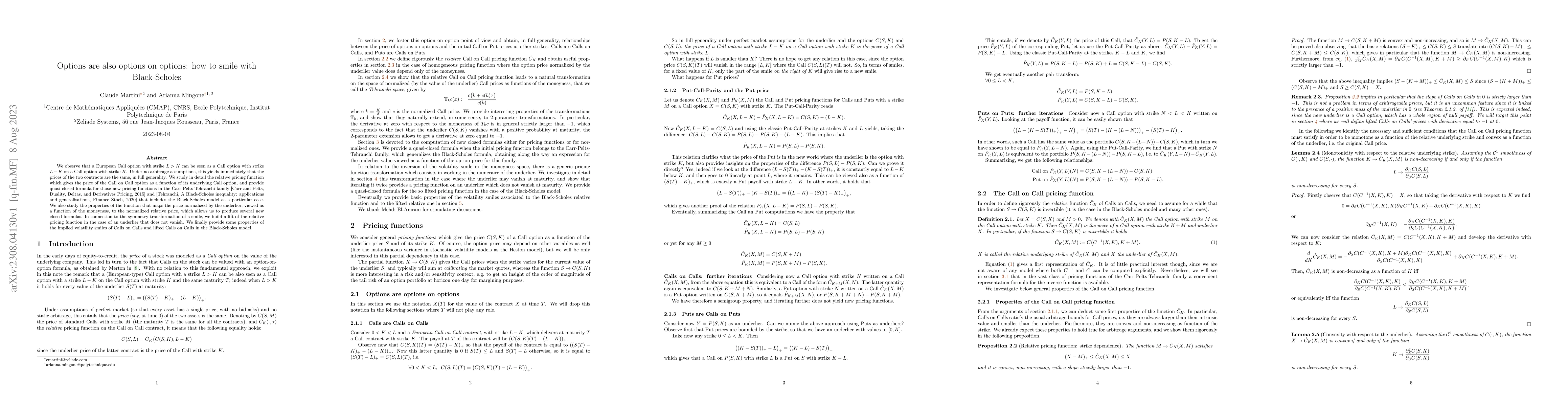

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInverse and Quanto Inverse Options in a Black-Scholes World

Ding Chen, Carol Alexander, Arben Imeraj

No citations found for this paper.

Comments (0)