Authors

Summary

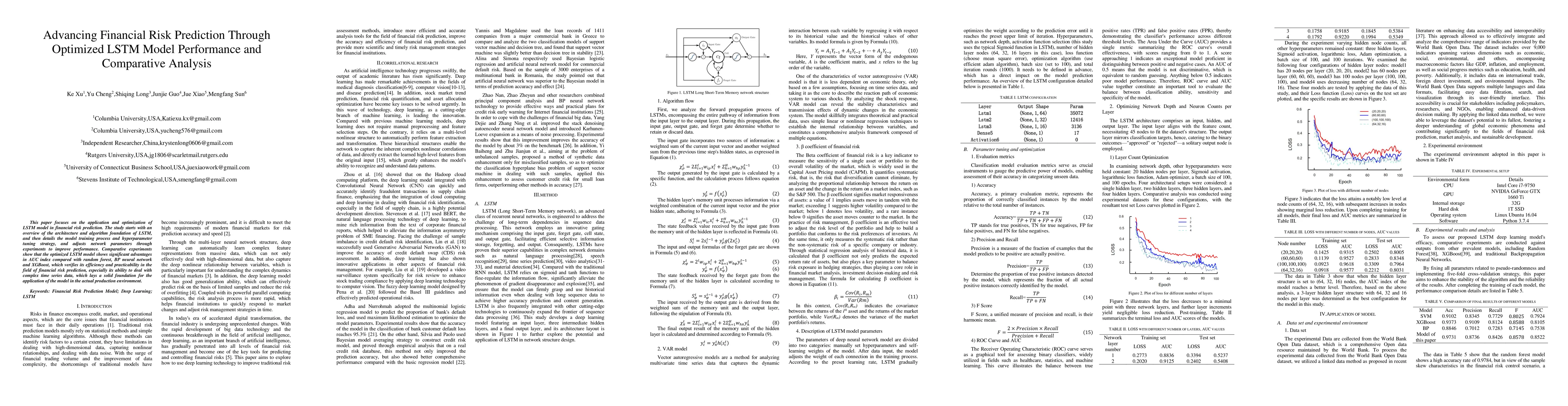

This paper focuses on the application and optimization of LSTM model in financial risk prediction. The study starts with an overview of the architecture and algorithm foundation of LSTM, and then details the model training process and hyperparameter tuning strategy, and adjusts network parameters through experiments to improve performance. Comparative experiments show that the optimized LSTM model shows significant advantages in AUC index compared with random forest, BP neural network and XGBoost, which verifies its efficiency and practicability in the field of financial risk prediction, especially its ability to deal with complex time series data, which lays a solid foundation for the application of the model in the actual production environment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)