Summary

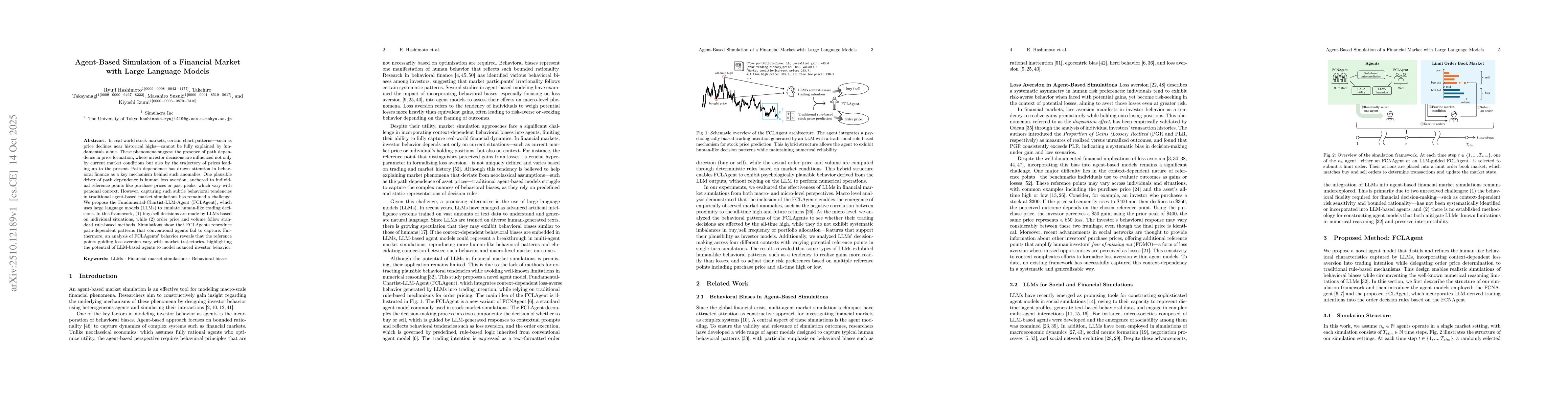

In real-world stock markets, certain chart patterns -- such as price declines near historical highs -- cannot be fully explained by fundamentals alone. These phenomena suggest the presence of path dependence in price formation, where investor decisions are influenced not only by current market conditions but also by the trajectory of prices leading up to the present. Path dependence has drawn attention in behavioral finance as a key mechanism behind such anomalies. One plausible driver of path dependence is human loss aversion, anchored to individual reference points like purchase prices or past peaks, which vary with personal context. However, capturing such subtle behavioral tendencies in traditional agent-based market simulations has remained a challenge. We propose the Fundamental-Chartist-LLM-Agent (FCLAgent), which uses large language models (LLMs) to emulate human-like trading decisions. In this framework, (1) buy/sell decisions are made by LLMs based on individual situations, while (2) order price and volume follow standard rule-based methods. Simulations show that FCLAgents reproduce path-dependent patterns that conventional agents fail to capture. Furthermore, an analysis of FCLAgents' behavior reveals that the reference points guiding loss aversion vary with market trajectories, highlighting the potential of LLM-based agents to model nuanced investor behavior.

AI Key Findings

Generated Oct 30, 2025

Methodology

The study employs agent-based modeling (ABM) enhanced by large language models (LLMs) to simulate financial market behaviors, incorporating behavioral biases and psychological factors into agent decision-making processes.

Key Results

- LLM-enhanced agents exhibit human-like intuitive reasoning biases and decision-making patterns

- The model successfully replicates stylized facts of financial markets including volatility clustering and fat-tailed distributions

- Agents display disposition effect and overreaction to recent price changes

Significance

This research advances financial market simulation by integrating cognitive biases and psychological factors, offering deeper insights into market dynamics and potential applications in risk management and policy-making.

Technical Contribution

Development of an LLM-augmented ABM framework that captures human-like behavioral patterns in financial markets

Novelty

Integration of large language models with agent-based modeling to simulate complex financial behaviors previously unattainable with traditional models

Limitations

- The model's complexity may limit real-time applicability

- Dependence on historical data may affect predictive accuracy

Future Work

- Exploring real-time market simulations with enhanced computational resources

- Investigating the impact of regulatory interventions on agent behavior

Paper Details

PDF Preview

Similar Papers

Found 5 papersSimulating Financial Market via Large Language Model based Agents

Yuntao Wen, Shen Gao, Shuo Shang et al.

Comments (0)