Summary

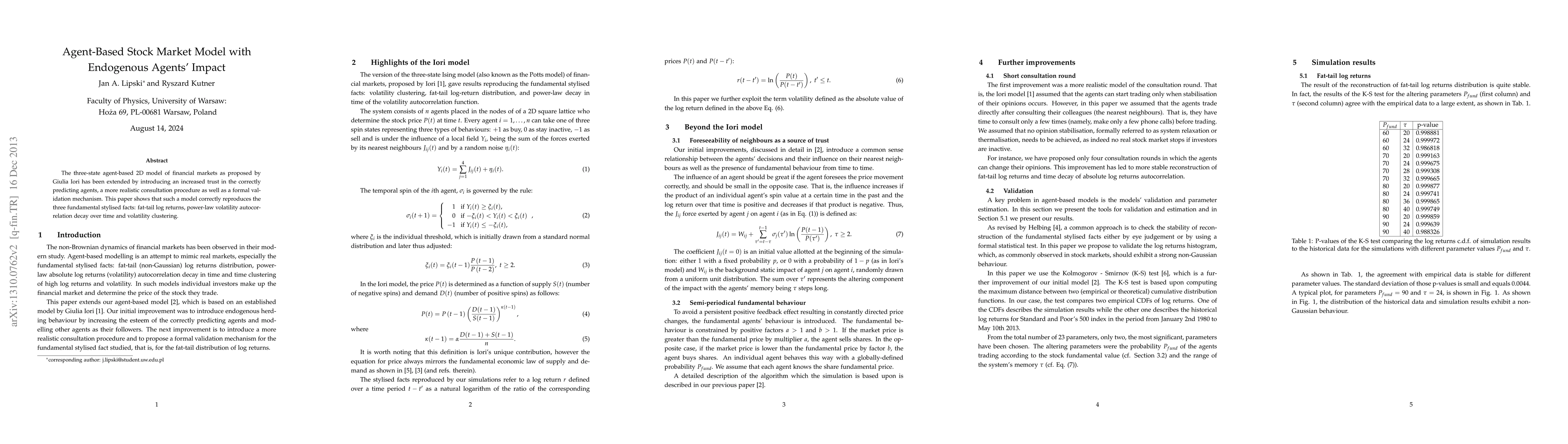

The three-state agent-based 2D model of financial markets as proposed by Giulia Iori has been extended by introducing increasing trust in the correctly predicting agents, a more realistic consultation procedure as well as a formal validation mechanism. This paper shows that such a model correctly reproduces the three fundamental stylised facts: fat-tail log returns, power-law volatility autocorrelation decay in time and volatility clustering.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMany learning agents interacting with an agent-based market model

Tim Gebbie, Matthew Dicks, Andrew Paskaramoorthy

| Title | Authors | Year | Actions |

|---|

Comments (0)