Authors

Summary

The recent banking crisis has again emphasized the importance of understanding and mitigating systemic risk in financial networks. In this paper, we study a market-driven approach to rescue a bank in distress based on the idea of claims trading, a notion defined in Chapter 11 of the U.S. Bankruptcy Code. We formalize the idea in the context of financial networks by Eisenberg and Noe. For two given banks v and w, we consider the operation that w takes over some claims of v and in return gives liquidity to v to ultimately rescue v. We study the structural properties and computational complexity of decision and optimization problems for several variants of claims trading. When trading incoming edges of v, we show that there is no trade in which both banks v and w strictly improve their assets. We therefore consider creditor-positive trades, in which v profits strictly and w remains indifferent. For a given set C of incoming edges of v, we provide an efficient algorithm to compute payments by w that result in maximal assets of v. When the set C must also be chosen, the problem becomes weakly NP-hard. Our main result here is a bicriteria FPTAS to compute an approximate trade. The approximate trade results in nearly the optimal amount of assets of v in any exact trade. Our results extend to the case in which banks use general monotone payment functions and the emerging clearing state can be computed efficiently. In contrast, for trading outgoing edges of v, the goal is to maximize the increase in assets for the creditors of v. Notably, for these results the characteristics of the payment functions of the banks are essential. For payments ranking creditors one by one, we show NP-hardness of approximation within a factor polynomial in the network size, when the set of claims C is part of the input or not. Instead, for proportional payments, our results indicate more favorable conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

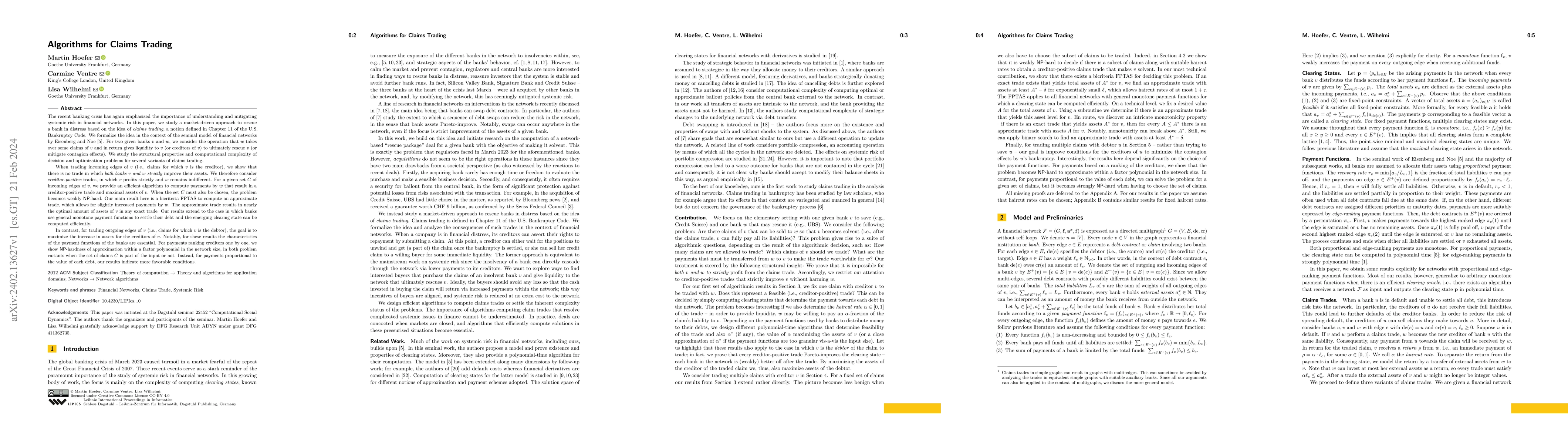

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFractional Claims Trades and Donations in Financial Networks

Martin Hoefer, Lisa Wilhelmi, Lars Huth

| Title | Authors | Year | Actions |

|---|

Comments (0)