Carmine Ventre

26 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

An Algorithmic Theory of Simplicity in Mechanism Design

A growing body of work in economics and computation focuses on the trade-off between implementability and simplicity in mechanism design. The goal is to develop a theory that not only allows to desi...

On the Redistribution of Maximal Extractable Value: A Dynamic Mechanism

Maximal Extractable Value (MEV) has emerged as a new frontier in the design of blockchain systems. The marriage between decentralization and finance gives the power to block producers (a.k.a., miner...

Algorithms for Claims Trading

The recent banking crisis has again emphasized the importance of understanding and mitigating systemic risk in financial networks. In this paper, we study a market-driven approach to rescue a bank i...

Willy Wonka Mechanisms

Bounded rationality in mechanism design aims to ensure incentive-compatibility for agents who are cognitively limited. These agents lack the contingent reasoning skills that traditional mechanism de...

Strategic Bidding Wars in On-chain Auctions

The Ethereum block-building process has changed significantly since the emergence of Proposer-Builder Separation. Validators access blocks through a marketplace, where block builders bid for the rig...

Clearing Financial Networks with Derivatives: From Intractability to Algorithms

Financial networks raise a significant computational challenge in identifying insolvent firms and evaluating their exposure to systemic risk. This task, known as the clearing problem, is computation...

An Empirical Analysis on Financial Markets: Insights from the Application of Statistical Physics

In this study, we introduce a physical model inspired by statistical physics for predicting price volatility and expected returns by leveraging Level 3 order book data. By drawing parallels between ...

Detecting Financial Market Manipulation with Statistical Physics Tools

We take inspiration from statistical physics to develop a novel conceptual framework for the analysis of financial markets. We model the order book dynamics as a motion of particles and define the m...

On the Connection between Greedy Algorithms and Imperfect Rationality

The design of algorithms or protocols that are able to align the goals of the planner with the selfish interests of the agents involved in these protocols is of paramount importance in almost every ...

A new encoding of implied volatility surfaces for their synthetic generation

In financial terms, an implied volatility surface can be described by its term structure, its skewness and its overall volatility level. We use a PCA variational auto-encoder model to perfectly repr...

Error in the Euclidean Preference Model

Spatial models of preference, in the form of vector embeddings, are learned by many deep learning and multiagent systems, including recommender systems. Often these models are assumed to approximate...

Non-Obvious Manipulability for Single-Parameter Agents and Bilateral Trade

A recent line of work in mechanism design has focused on guaranteeing incentive compatibility for agents without contingent reasoning skills: obviously strategyproof mechanisms guarantee that it is ...

Denoised Labels for Financial Time-Series Data via Self-Supervised Learning

The introduction of electronic trading platforms effectively changed the organisation of traditional systemic trading from quote-driven markets into order-driven markets. Its convenience led to an e...

Strong Approximations and Irrationality in Financial Networks with Financial Derivatives

Financial networks model a set of financial institutions (firms) interconnected by obligations. Recent work has introduced to this model a class of obligations called credit default swaps, a certain...

Cryptocurrency Trading: A Comprehensive Survey

In recent years, the tendency of the number of financial institutions including cryptocurrencies in their portfolios has accelerated. Cryptocurrencies are the first pure digital assets to be include...

A Financial Time Series Denoiser Based on Diffusion Model

Financial time series often exhibit low signal-to-noise ratio, posing significant challenges for accurate data interpretation and prediction and ultimately decision making. Generative models have gain...

Scalable Signature-Based Distribution Regression via Reference Sets

Distribution Regression (DR) on stochastic processes describes the learning task of regression on collections of time series. Path signatures, a technique prevalent in stochastic analysis, have been u...

Asymptotic Extinction in Large Coordination Games

We study the exploration-exploitation trade-off for large multiplayer coordination games where players strategise via Q-Learning, a common learning framework in multi-agent reinforcement learning. Q-L...

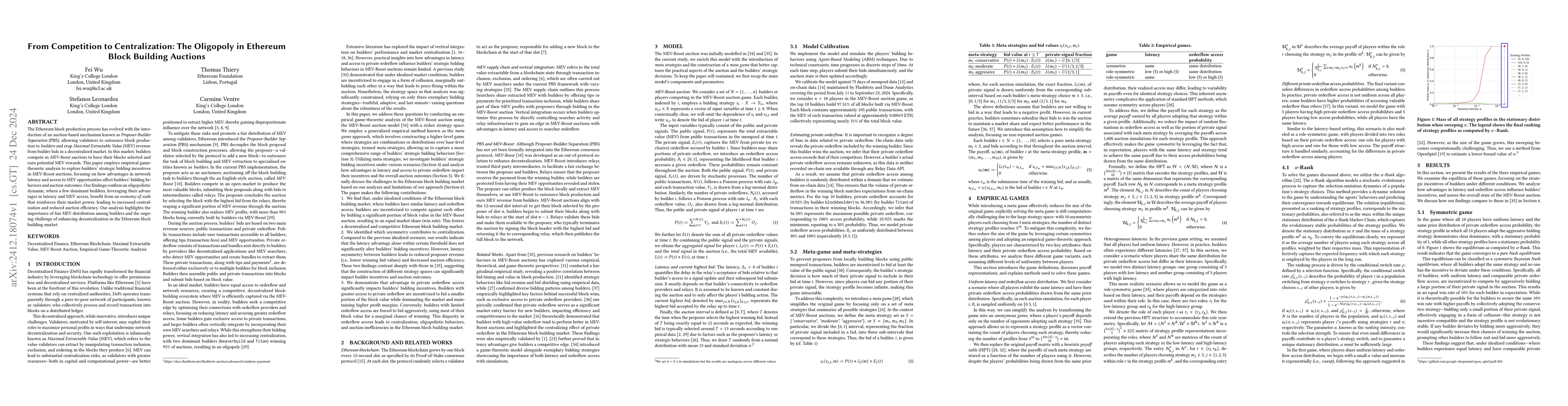

From Competition to Centralization: The Oligopoly in Ethereum Block Building Auctions

The Ethereum block production process has evolved with the introduction of an auction-based mechanism known as Proposer-Builder Separation (PBS), allowing validators to outsource block production to b...

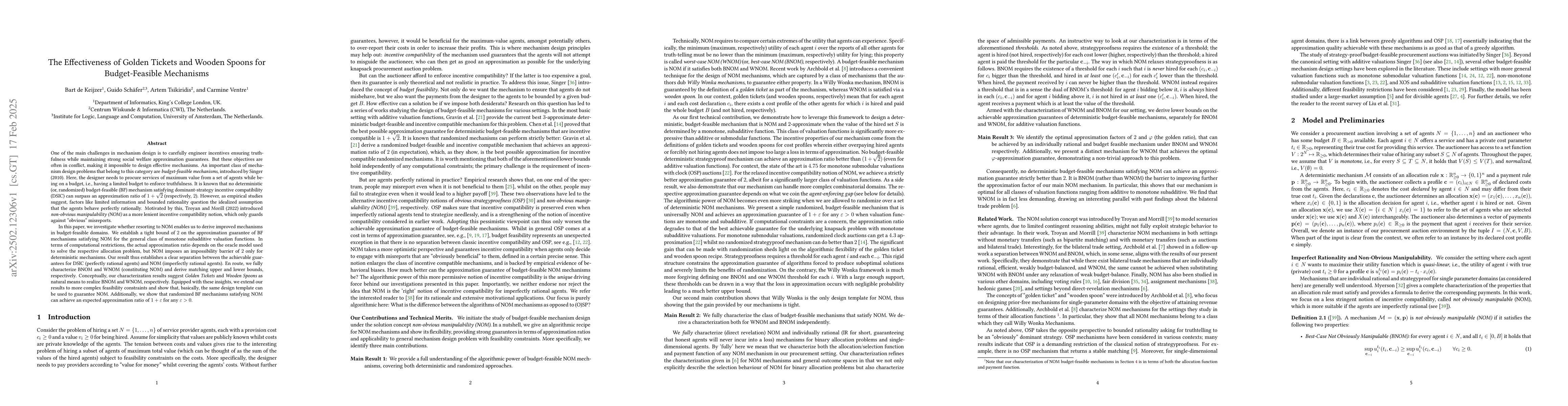

The Effectiveness of Golden Tickets and Wooden Spoons for Budget-Feasible Mechanisms

One of the main challenges in mechanism design is to carefully engineer incentives ensuring truthfulness while maintaining strong social welfare approximation guarantees. But these objectives are ofte...

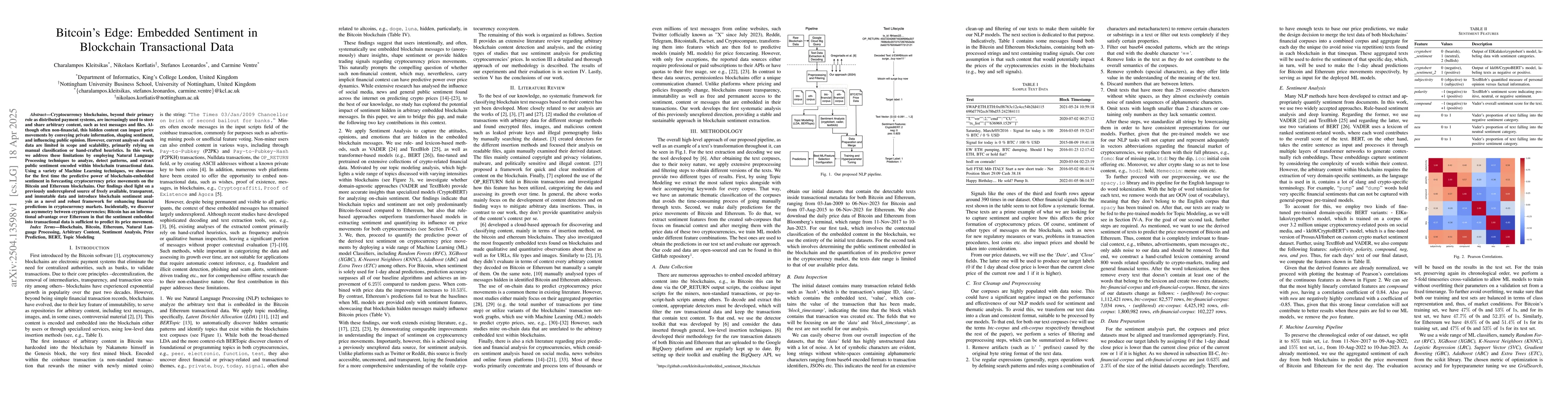

Bitcoin's Edge: Embedded Sentiment in Blockchain Transactional Data

Cryptocurrency blockchains, beyond their primary role as distributed payment systems, are increasingly used to store and share arbitrary content, such as text messages and files. Although often non-fi...

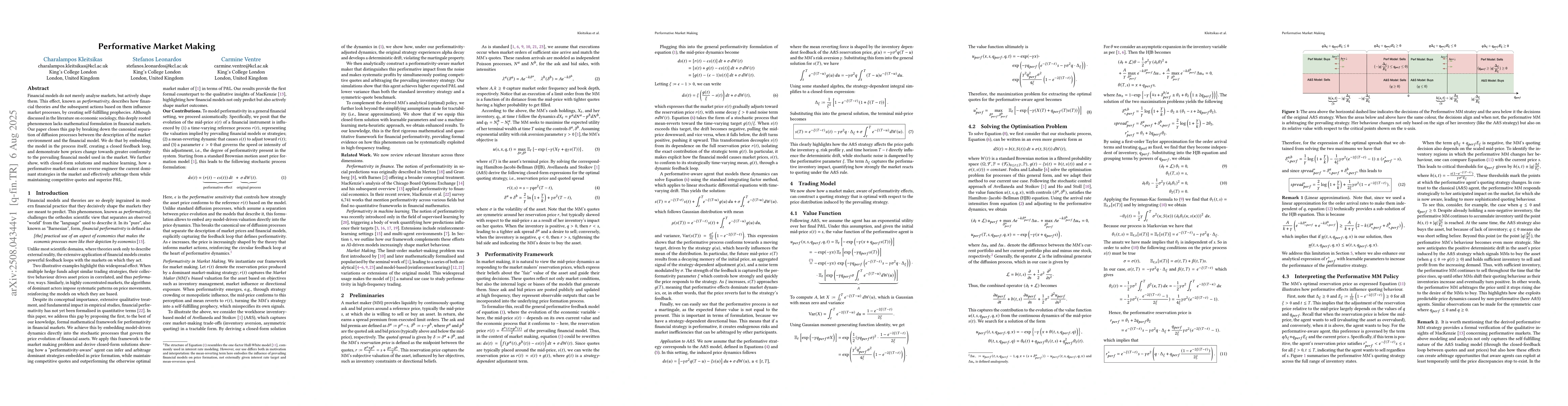

Performative Market Making

Financial models do not merely analyse markets, but actively shape them. This effect, known as performativity, describes how financial theories and the subsequent actions based on them influence marke...

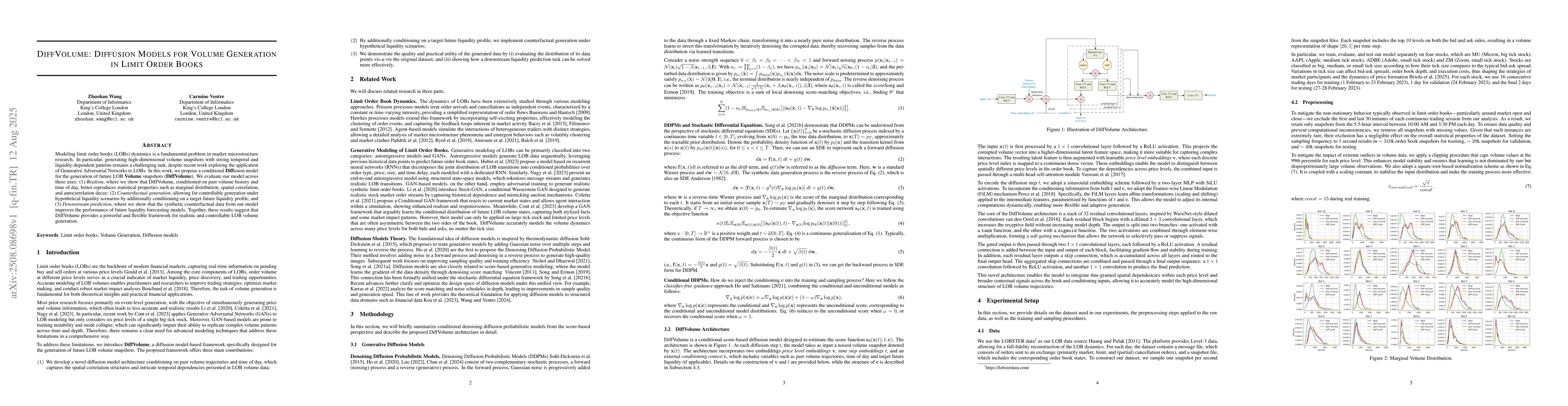

DiffVolume: Diffusion Models for Volume Generation in Limit Order Books

Modeling limit order books (LOBs) dynamics is a fundamental problem in market microstructure research. In particular, generating high-dimensional volume snapshots with strong temporal and liquidity-de...

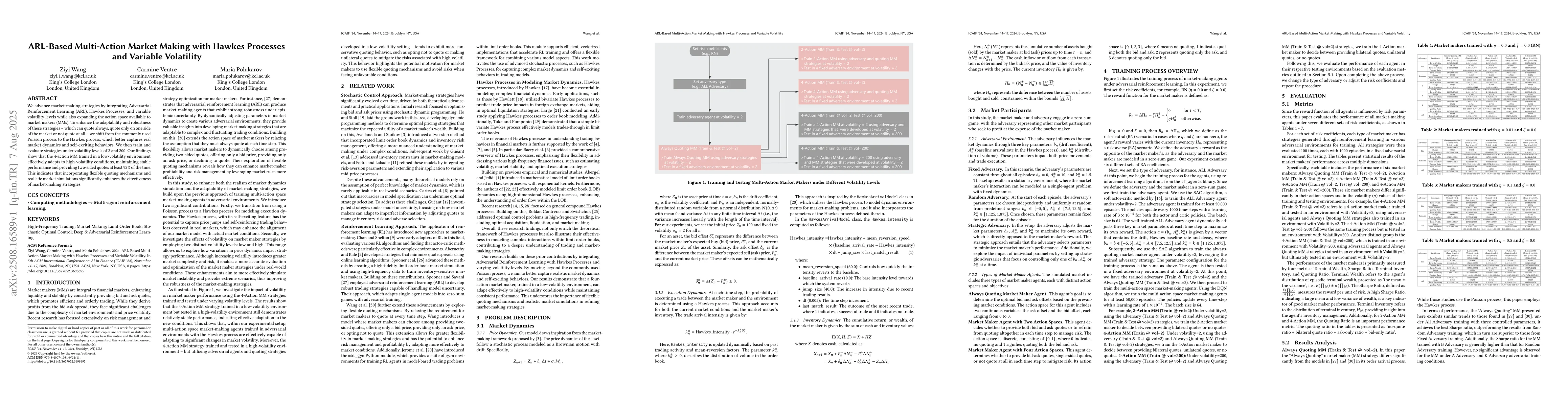

ARL-Based Multi-Action Market Making with Hawkes Processes and Variable Volatility

We advance market-making strategies by integrating Adversarial Reinforcement Learning (ARL), Hawkes Processes, and variable volatility levels while also expanding the action space available to market ...

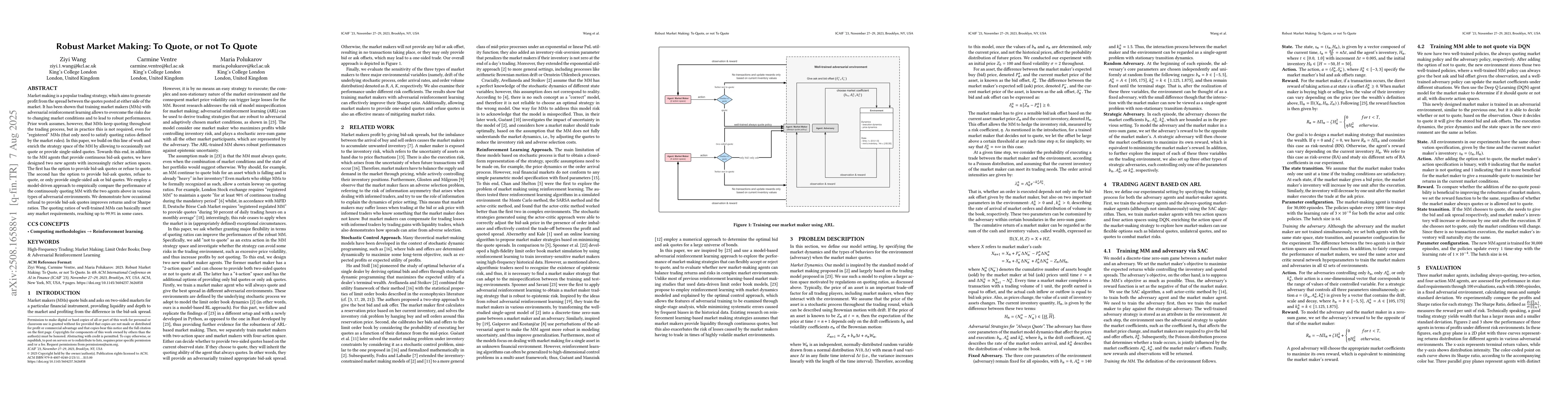

Robust Market Making: To Quote, or not To Quote

Market making is a popular trading strategy, which aims to generate profit from the spread between the quotes posted at either side of the market. It has been shown that training market makers (MMs) w...

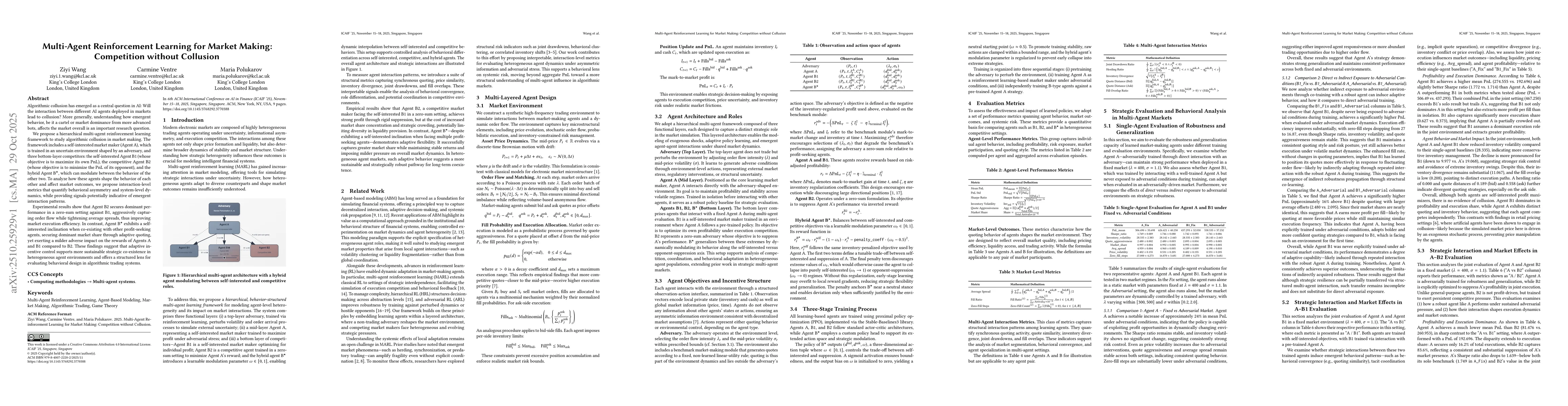

Multi-Agent Reinforcement Learning for Market Making: Competition without Collusion

Algorithmic collusion has emerged as a central question in AI: Will the interaction between different AI agents deployed in markets lead to collusion? More generally, understanding how emergent behavi...