Authors

Summary

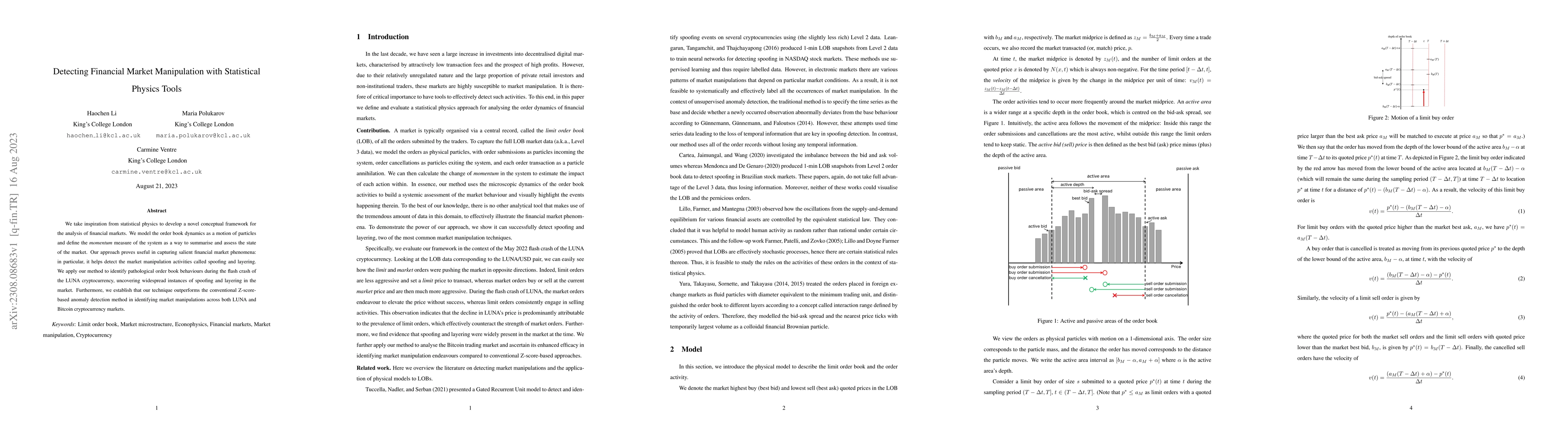

We take inspiration from statistical physics to develop a novel conceptual framework for the analysis of financial markets. We model the order book dynamics as a motion of particles and define the momentum measure of the system as a way to summarise and assess the state of the market. Our approach proves useful in capturing salient financial market phenomena: in particular, it helps detect the market manipulation activities called spoofing and layering. We apply our method to identify pathological order book behaviours during the flash crash of the LUNA cryptocurrency, uncovering widespread instances of spoofing and layering in the market. Furthermore, we establish that our technique outperforms the conventional Z-score-based anomaly detection method in identifying market manipulations across both LUNA and Bitcoin cryptocurrency markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNovel Market Temperature Definition Through Fluctuation Theorem: A Statistical Physics Framework for Financial Crisis Prediction

Mehdi Ramezani, Masoome Ramezani, Fereydoun Rahnama Roodposhti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)