Authors

Summary

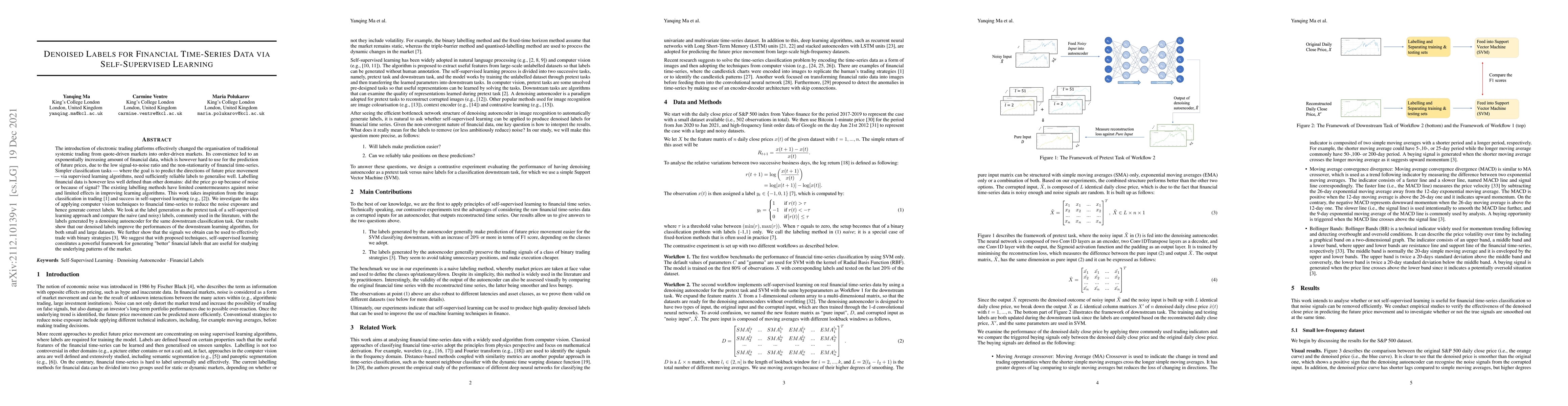

The introduction of electronic trading platforms effectively changed the organisation of traditional systemic trading from quote-driven markets into order-driven markets. Its convenience led to an exponentially increasing amount of financial data, which is however hard to use for the prediction of future prices, due to the low signal-to-noise ratio and the non-stationarity of financial time series. Simpler classification tasks -- where the goal is to predict the directions of future price movement -- via supervised learning algorithms, need sufficiently reliable labels to generalise well. Labelling financial data is however less well defined than other domains: did the price go up because of noise or because of signal? The existing labelling methods have limited countermeasures against noise and limited effects in improving learning algorithms. This work takes inspiration from image classification in trading and success in self-supervised learning. We investigate the idea of applying computer vision techniques to financial time-series to reduce the noise exposure and hence generate correct labels. We look at the label generation as the pretext task of a self-supervised learning approach and compare the naive (and noisy) labels, commonly used in the literature, with the labels generated by a denoising autoencoder for the same downstream classification task. Our results show that our denoised labels improve the performances of the downstream learning algorithm, for both small and large datasets. We further show that the signals we obtain can be used to effectively trade with binary strategies. We suggest that with proposed techniques, self-supervised learning constitutes a powerful framework for generating "better" financial labels that are useful for studying the underlying patterns of the market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNot All Data are Good Labels: On the Self-supervised Labeling for Time Series Forecasting

Gang Chen, Huan Li, Dalin Zhang et al.

Self-supervised Contrastive Representation Learning for Semi-supervised Time-Series Classification

Mohamed Ragab, Min Wu, Zhenghua Chen et al.

Self-Supervised Learning of Disentangled Representations for Multivariate Time-Series

Ching Chang, Wen-Chih Peng, Wei-Yao Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)