Summary

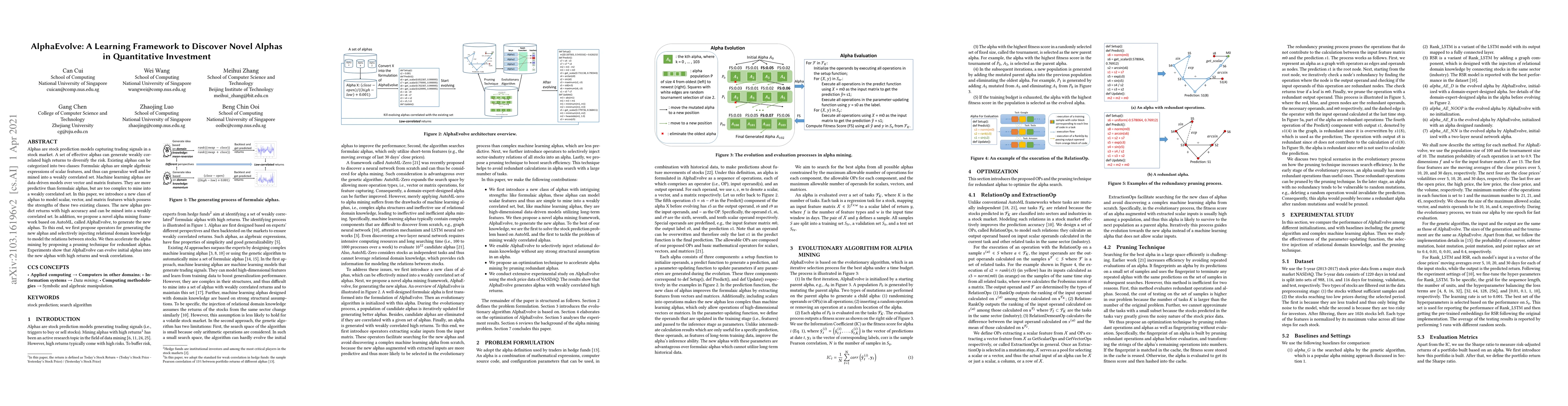

Alphas are stock prediction models capturing trading signals in a stock market. A set of effective alphas can generate weakly correlated high returns to diversify the risk. Existing alphas can be categorized into two classes: Formulaic alphas are simple algebraic expressions of scalar features, and thus can generalize well and be mined into a weakly correlated set. Machine learning alphas are data-driven models over vector and matrix features. They are more predictive than formulaic alphas, but are too complex to mine into a weakly correlated set. In this paper, we introduce a new class of alphas to model scalar, vector, and matrix features which possess the strengths of these two existing classes. The new alphas predict returns with high accuracy and can be mined into a weakly correlated set. In addition, we propose a novel alpha mining framework based on AutoML, called AlphaEvolve, to generate the new alphas. To this end, we first propose operators for generating the new alphas and selectively injecting relational domain knowledge to model the relations between stocks. We then accelerate the alpha mining by proposing a pruning technique for redundant alphas. Experiments show that AlphaEvolve can evolve initial alphas into the new alphas with high returns and weak correlations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom Deep Learning to LLMs: A survey of AI in Quantitative Investment

Jian Guo, Xiaojun Wu, Saizhuo Wang et al.

Alpha-GPT: Human-AI Interactive Alpha Mining for Quantitative Investment

Jian Guo, Heung-Yeung Shum, Saizhuo Wang et al.

Quantitative Stock Investment by Routing Uncertainty-Aware Trading Experts: A Multi-Task Learning Approach

Shuo Sun, Bo An, Rundong Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)