Authors

Summary

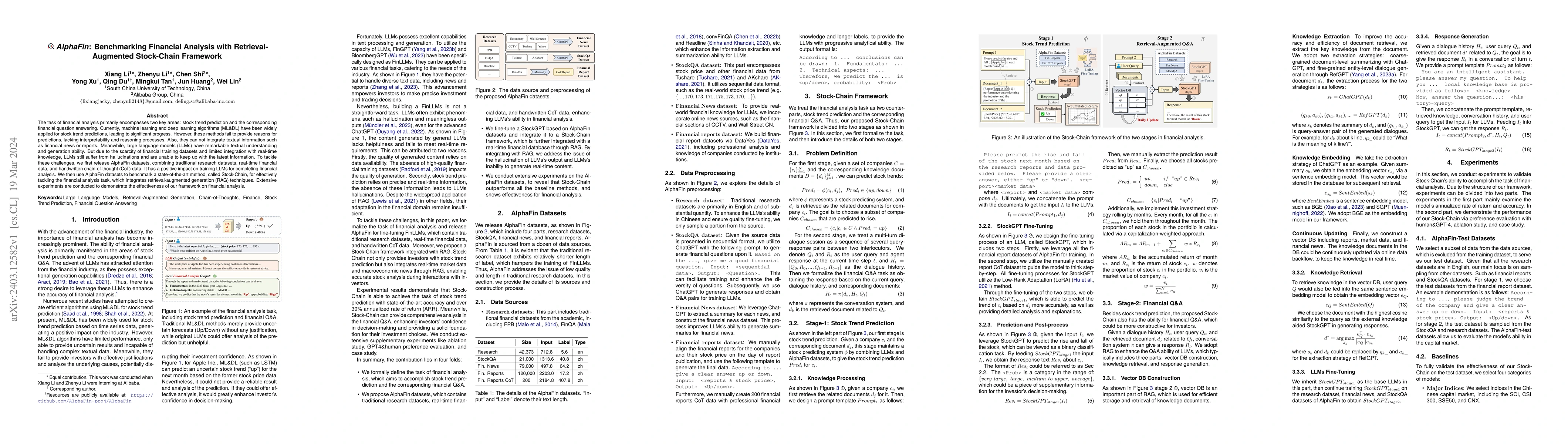

The task of financial analysis primarily encompasses two key areas: stock trend prediction and the corresponding financial question answering. Currently, machine learning and deep learning algorithms (ML&DL) have been widely applied for stock trend predictions, leading to significant progress. However, these methods fail to provide reasons for predictions, lacking interpretability and reasoning processes. Also, they can not integrate textual information such as financial news or reports. Meanwhile, large language models (LLMs) have remarkable textual understanding and generation ability. But due to the scarcity of financial training datasets and limited integration with real-time knowledge, LLMs still suffer from hallucinations and are unable to keep up with the latest information. To tackle these challenges, we first release AlphaFin datasets, combining traditional research datasets, real-time financial data, and handwritten chain-of-thought (CoT) data. It has a positive impact on training LLMs for completing financial analysis. We then use AlphaFin datasets to benchmark a state-of-the-art method, called Stock-Chain, for effectively tackling the financial analysis task, which integrates retrieval-augmented generation (RAG) techniques. Extensive experiments are conducted to demonstrate the effectiveness of our framework on financial analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Financial Time-Series Forecasting with Retrieval-Augmented Large Language Models

Zhengyu Chen, Jimin Huang, Sophia Ananiadou et al.

Enhancing Financial Sentiment Analysis via Retrieval Augmented Large Language Models

Xiao-Yang Liu, Hongyang Yang, Boyu Zhang et al.

MultiFinRAG: An Optimized Multimodal Retrieval-Augmented Generation (RAG) Framework for Financial Question Answering

Urjitkumar Patel, Fang-Chun Yeh, Chinmay Gondhalekar

Aligning LLMs with Human Instructions and Stock Market Feedback in Financial Sentiment Analysis

Zijie Zhao, Roy E. Welsch

| Title | Authors | Year | Actions |

|---|

Comments (0)