Summary

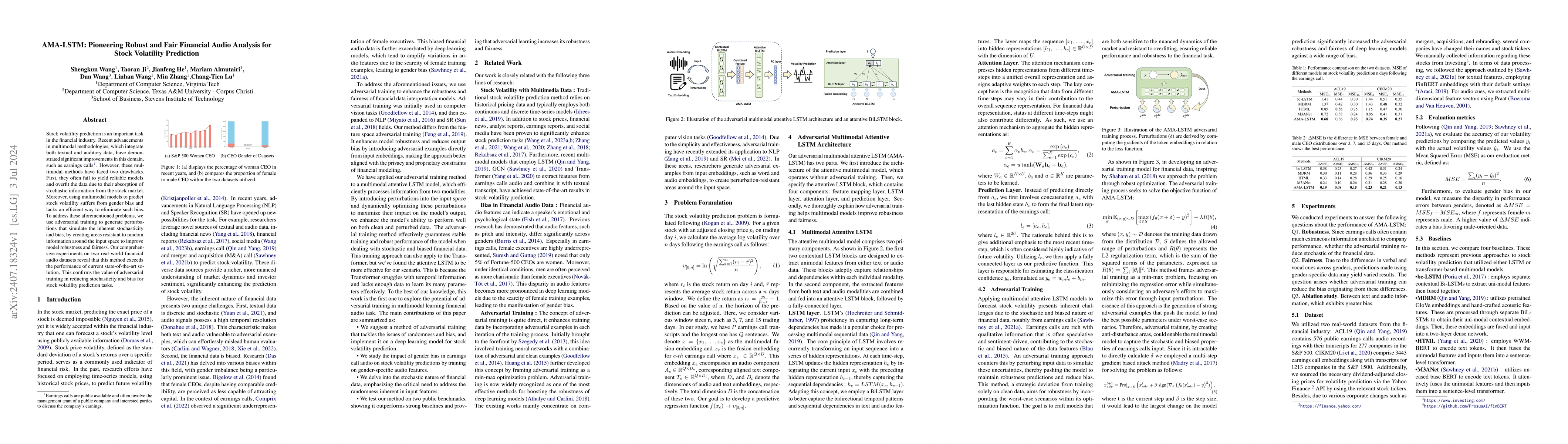

Stock volatility prediction is an important task in the financial industry. Recent advancements in multimodal methodologies, which integrate both textual and auditory data, have demonstrated significant improvements in this domain, such as earnings calls (Earnings calls are public available and often involve the management team of a public company and interested parties to discuss the company's earnings). However, these multimodal methods have faced two drawbacks. First, they often fail to yield reliable models and overfit the data due to their absorption of stochastic information from the stock market. Moreover, using multimodal models to predict stock volatility suffers from gender bias and lacks an efficient way to eliminate such bias. To address these aforementioned problems, we use adversarial training to generate perturbations that simulate the inherent stochasticity and bias, by creating areas resistant to random information around the input space to improve model robustness and fairness. Our comprehensive experiments on two real-world financial audio datasets reveal that this method exceeds the performance of current state-of-the-art solution. This confirms the value of adversarial training in reducing stochasticity and bias for stock volatility prediction tasks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparative Analysis of LSTM, GRU, and Transformer Models for Stock Price Prediction

Jue Xiao, Shuochen Bi, Tingting Deng

Fair Volatility: A Framework for Reconceptualizing Financial Risk

Daniele Angelini, Sergio Bianchi

| Title | Authors | Year | Actions |

|---|

Comments (0)