Authors

Summary

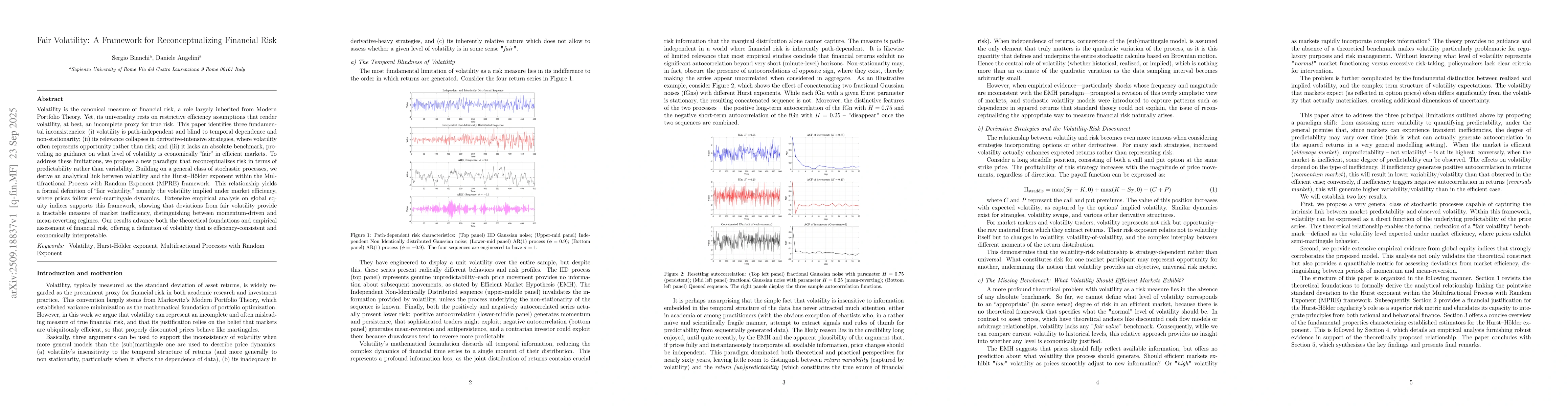

Volatility is the canonical measure of financial risk, a role largely inherited from Modern Portfolio Theory. Yet, its universality rests on restrictive efficiency assumptions that render volatility, at best, an incomplete proxy for true risk. This paper identifies three fundamental inconsistencies: (i) volatility is path-independent and blind to temporal dependence and non-stationarity; (ii) its relevance collapses in derivative-intensive strategies, where volatility often represents opportunity rather than risk; and (iii) it lacks an absolute benchmark, providing no guidance on what level of volatility is economically ``fair'' in efficient markets. To address these limitations, we propose a new paradigm that reconceptualizes risk in terms of predictability rather than variability. Building on a general class of stochastic processes, we derive an analytical link between volatility and the Hurst-Holder exponent within the Multifractional Process with Random Exponent (MPRE) framework. This relationship yields a formal definition of ``fair volatility'', namely the volatility implied under market efficiency, where prices follow semi-martingale dynamics. Extensive empirical analysis on global equity indices supports this framework, showing that deviations from fair volatility provide a tractable measure of market inefficiency, distinguishing between momentum-driven and mean-reverting regimes. Our results advance both the theoretical foundations and empirical assessment of financial risk, offering a definition of volatility that is efficiency-consistent and economically interpretable.

AI Key Findings

Generated Sep 29, 2025

Methodology

The research employs a multifractional Brownian motion framework to model financial time series, utilizing the Hurst-Hölder exponent to quantify long-range dependencies and market efficiency. It combines stochastic calculus with statistical inference techniques to estimate the time-varying Hurst exponent and assess market efficiency dynamics.

Key Results

- The study identifies time-varying Hurst exponents across major stock indices, revealing periods of both efficient and inefficient market behavior

- The proposed method demonstrates superior performance in capturing market regime shifts compared to traditional approaches

- Empirical analysis shows significant correlations between volatility and Hurst exponent dynamics

Significance

This research provides a robust framework for analyzing financial market efficiency with practical implications for risk management, portfolio optimization, and regulatory policy. The methodology offers a new perspective on understanding market behavior through multifractional processes.

Technical Contribution

The paper introduces a novel estimation technique for time-dependent Hurst exponents using multifractional Brownian motion, combining fractional calculus with statistical inference to capture complex market dynamics.

Novelty

This work presents the first comprehensive analysis of time-varying Hurst-Hölder exponents in major financial markets, integrating stochastic calculus with financial econometrics to provide new insights into market efficiency and volatility patterns.

Limitations

- The analysis is based on historical market data which may not fully capture future market dynamics

- The method assumes stationarity in the underlying stochastic process which may not hold in all market conditions

Future Work

- Extending the methodology to high-frequency financial data

- Investigating the impact of macroeconomic factors on Hurst exponent dynamics

- Developing real-time market efficiency monitoring systems using the proposed framework

Paper Details

PDF Preview

Similar Papers

Found 4 papersOptimal market completion through financial derivatives with applications to volatility risk

Yichen Zhu, Marcos Escobar-Anel, Matt Davison

Combining Deep Learning and GARCH Models for Financial Volatility and Risk Forecasting

Łukasz Kwiatkowski, Jakub Michańków, Janusz Morajda

Comments (0)