Summary

In this paper, we develop a hybrid approach to forecasting the volatility and risk of financial instruments by combining common econometric GARCH time series models with deep learning neural networks. For the latter, we employ Gated Recurrent Unit (GRU) networks, whereas four different specifications are used as the GARCH component: standard GARCH, EGARCH, GJR-GARCH and APARCH. Models are tested using daily logarithmic returns on the S&P 500 index as well as gold price Bitcoin prices, with the three assets representing quite distinct volatility dynamics. As the main volatility estimator, also underlying the target function of our hybrid models, we use the price-range-based Garman-Klass estimator, modified to incorporate the opening and closing prices. Volatility forecasts resulting from the hybrid models are employed to evaluate the assets' risk using the Value-at-Risk (VaR) and Expected Shortfall (ES) at two different tolerance levels of 5% and 1%. Gains from combining the GARCH and GRU approaches are discussed in the contexts of both the volatility and risk forecasts. In general, it can be concluded that the hybrid solutions produce more accurate point volatility forecasts, although it does not necessarily translate into superior VaR and ES forecasts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

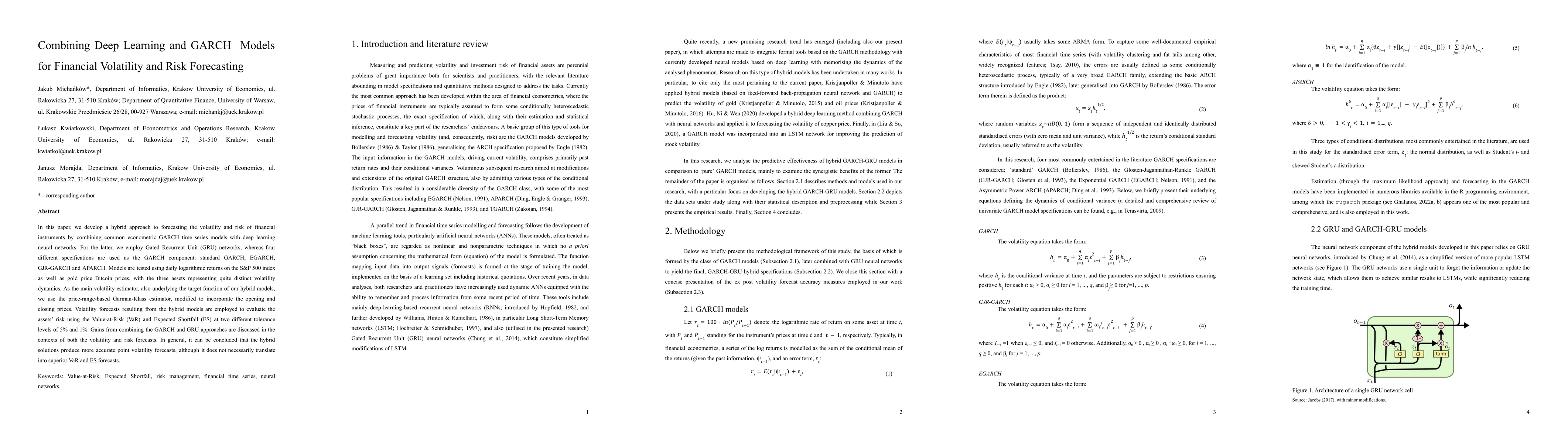

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntegrated GARCH-GRU in Financial Volatility Forecasting

Zhenyu Cui, Steve Yang, Jingyi Wei

GARCH-Informed Neural Networks for Volatility Prediction in Financial Markets

Christopher McComb, Zeda Xu, Sebastian Benthall et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)