Authors

Summary

Despite significant advancements in machine learning for derivative pricing, the efficient and accurate valuation of American options remains a persistent challenge due to complex exercise boundaries, near-expiry behavior, and intricate contractual features. This paper extends a semi-analytical approach for pricing American options in time-inhomogeneous models, including pure diffusions, jump-diffusions, and Levy processes. Building on prior work, we derive and solve Volterra integral equations of the second kind to determine the exercise boundary explicitly, offering a computationally superior alternative to traditional finite-difference and Monte Carlo methods. We address key open problems: (1) extending the decomposition method, i.e. splitting the American option price into its European counterpart and an early exercise premium, to general jump-diffusion and Levy models; (2) handling cases where closed-form transition densities are unavailable by leveraging characteristic functions via, e.g., the COS method; and (3) generalizing the framework to multidimensional diffusions. Numerical examples demonstrate the method's efficiency and robustness. Our results underscore the advantages of the integral equation approach for large-scale industrial applications, while resolving some limitations of existing techniques.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

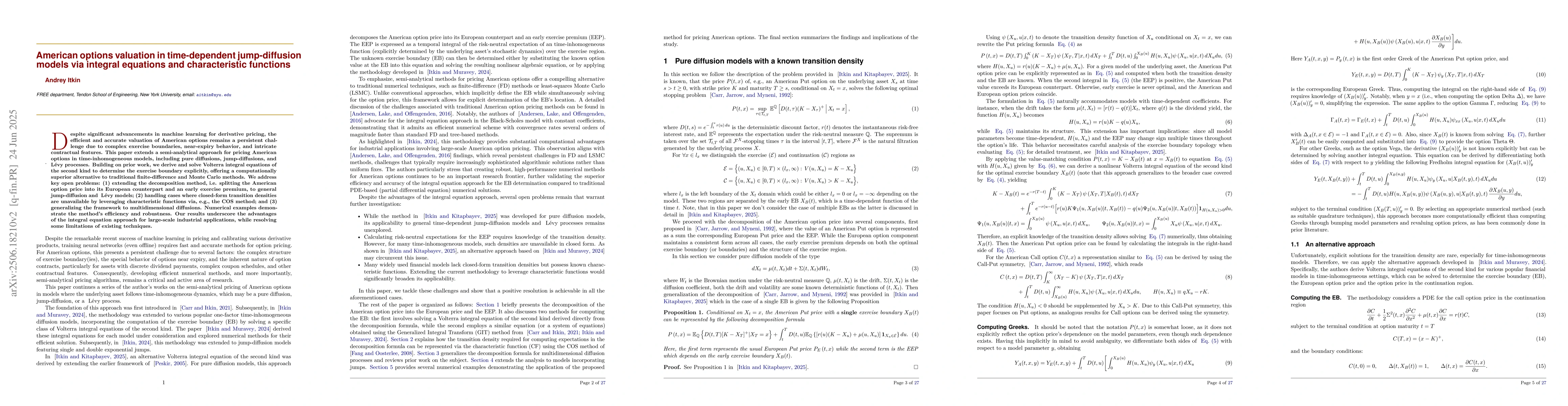

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSemi-analytic pricing of American options in time-dependent jump-diffusion models with exponential jumps

Andrey Itkin

No citations found for this paper.

Comments (0)