Authors

Summary

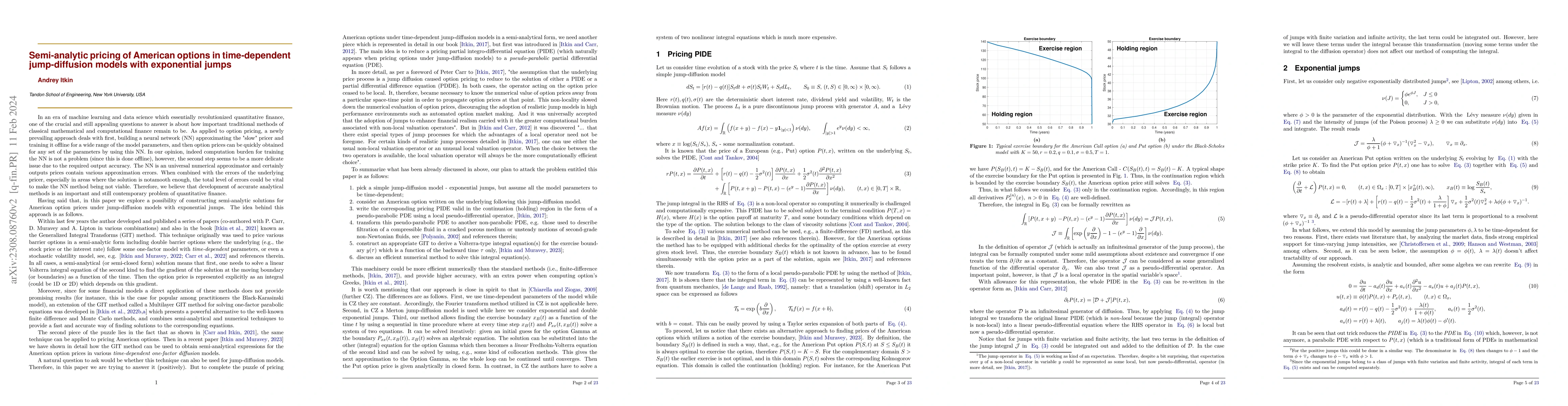

In this paper we propose a semi-analytic approach to pricing American options for time-dependent jump-diffusions models with exponential jumps The idea of the method is to further generalize our approach developed for pricing barrier, [Itkin et al., 2021], and American, [Carr and Itkin, 2021; Itkin and Muravey, 2023], options in various time-dependent one factor and even stochastic volatility models. Our approach i) allows arbitrary dependencies of the model parameters on time; ii) reduces solution of the pricing problem for American options to a simpler problem of solving a system of an algebraic nonlinear equation for the exercise boundary and a linear Fredholm-Volterra equation for the the option price; iii) the options Greeks solve a similar Fredholm-Volterra linear equation obtained by just differentiating Eq. (25) by the required parameter. Once done, the American option price is presented in close form.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersAmerican options in time-dependent one-factor models: Semi-analytic pricing, numerical methods and ML support

Andrey Itkin, Dmitry Muravey

| Title | Authors | Year | Actions |

|---|

Comments (0)