Summary

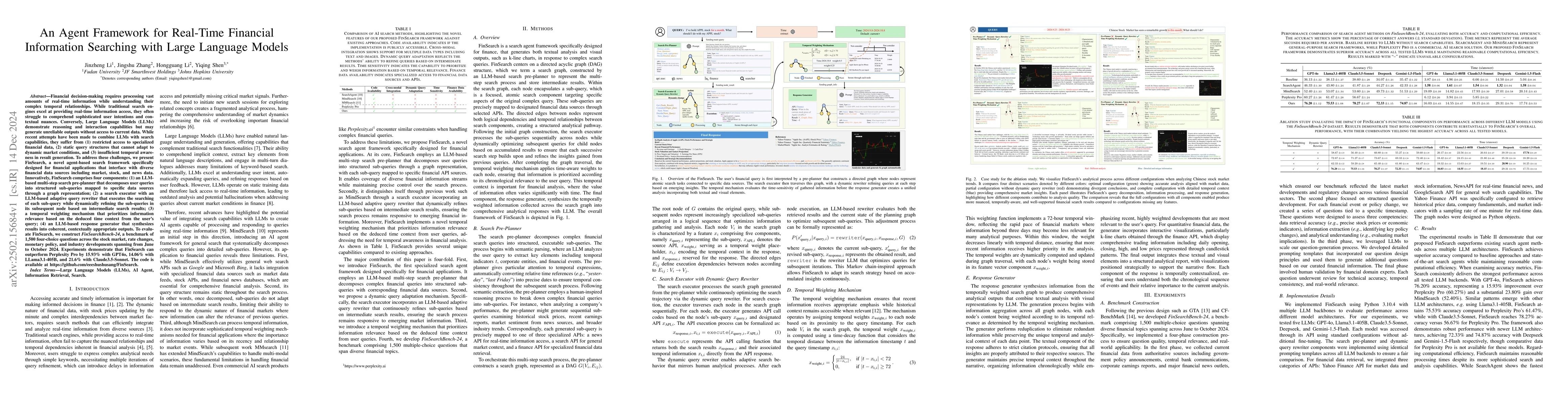

Financial decision-making requires processing vast amounts of real-time information while understanding their complex temporal relationships. While traditional search engines excel at providing real-time information access, they often struggle to comprehend sophisticated user intentions and contextual nuances. Conversely, Large Language Models (LLMs) demonstrate reasoning and interaction capabilities but may generate unreliable outputs without access to current data. While recent attempts have been made to combine LLMs with search capabilities, they suffer from (1) restricted access to specialized financial data, (2) static query structures that cannot adapt to dynamic market conditions, and (3) insufficient temporal awareness in result generation. To address these challenges, we present FinSearch, a novel agent-based search framework specifically designed for financial applications that interface with diverse financial data sources including market, stock, and news data. Innovatively, FinSearch comprises four components: (1) an LLM-based multi-step search pre-planner that decomposes user queries into structured sub-queries mapped to specific data sources through a graph representation; (2) a search executor with an LLM-based adaptive query rewriter that executes the searching of each sub-query while dynamically refining the sub-queries in its subsequent node based on intermediate search results; (3) a temporal weighting mechanism that prioritizes information relevance based on the deduced time context from the user's query; (4) an LLM-based response generator that synthesizes results into coherent, contextually appropriate outputs. To evaluate FinSearch, we construct FinSearchBench-24, a benchmark of 1,500 four-choice questions across the stock market, rate changes, monetary policy, and industry developments spanning from June to October 2024.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinBloom: Knowledge Grounding Large Language Model with Real-time Financial Data

Ankur Sinha, Chaitanya Agarwal, Pekka Malo

AI Analyst: Framework and Comprehensive Evaluation of Large Language Models for Financial Time Series Report Generation

Manuela Veloso, Rachneet Kaur, Zhen Zeng et al.

LLM4FTS: Enhancing Large Language Models for Financial Time Series Prediction

Zian Liu, Renjun Jia

FinLLMs: A Framework for Financial Reasoning Dataset Generation with Large Language Models

Ye Yuan, Wenqi Wei, Kaiyuan Wang et al.

No citations found for this paper.

Comments (0)