Summary

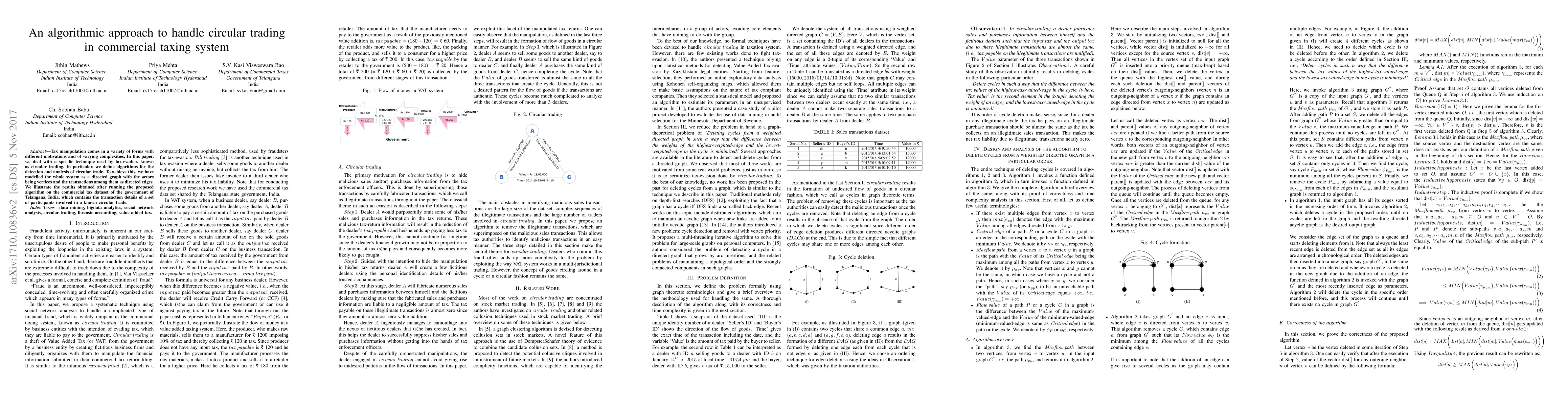

Tax manipulation comes in a variety of forms with different motivations and of varying complexities. In this paper, we deal with a specific technique used by tax-evaders known as circular trading. In particular, we define algorithms for the detection and analysis of circular trade. To achieve this, we have modelled the whole system as a directed graph with the actors being vertices and the transactions among them as directed edges. We illustrate the results obtained after running the proposed algorithm on the commercial tax dataset of the government of Telangana, India, which contains the transaction details of a set of participants involved in a known circular trade.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Application of Deep Reinforcement Learning to Algorithmic Trading

Damien Ernst, Thibaut Théate

PLUTUS Open Source -- Breaking Barriers in Algorithmic Trading

An-Dan Nguyen, Quang-Khoi Ta, Duy-Anh Vo

No citations found for this paper.

Comments (0)