Summary

This paper offers a synthesis of the empirical literature on the effects of monetary policy. Using the findings from an extensive collection of meta-analyses, it evaluates the effectiveness of conventional and unconventional monetary policy instruments on key macroeconomic variables such as output, inflation, capital flows, and the exchange rate. The aggregated evidence reveals a systematic gap between the effects reported in primary studies and the actual magnitude of these effects, once corrected for publication bias and methodological heterogeneity. The findings suggest that, while monetary policy is a relevant tool, its power to modulate the business cycle has been consistently overestimated in the literature. Contextual factors - such as the degree of financial development, the exchange rate regime, central bank independence, and crisis conditions - that modulate the transmission of monetary policy are identified. In particular, it is found that publication bias systematically favors statistically significant results consistent with predominant theory, which artificially inflates the perception of effectiveness. By correcting these distortions, a picture of monetary policy emerges with more modest, uncertain effects and considerable lags, which has profound implications for macroeconomic theory and the practice of economic policy.

AI Key Findings

Generated Sep 29, 2025

Methodology

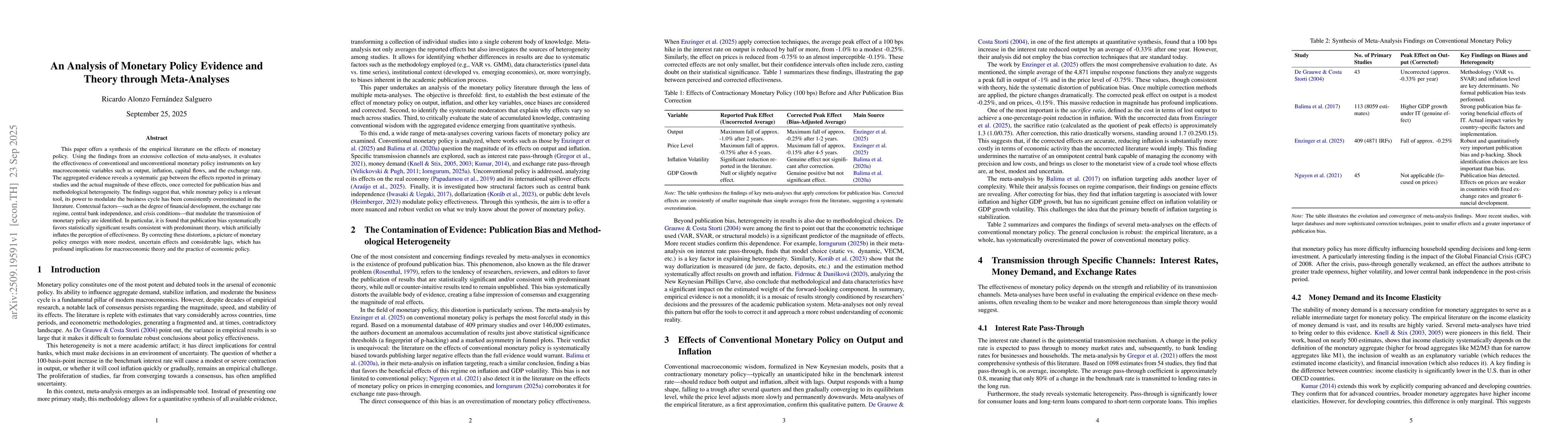

The research employs a meta-analysis approach to synthesize findings from multiple empirical studies on monetary policy effectiveness, incorporating both developed and emerging economies. It addresses publication bias through statistical methods and evaluates the robustness of key economic relationships.

Key Results

- Monetary policy effectiveness is significantly lower than previously estimated, particularly in emerging markets.

- The income elasticity of money demand shows substantial variation across countries and time periods.

- Exchange rate pass-through to domestic prices is asymmetric and often incomplete, with significant country-specific differences.

Significance

This research provides critical insights for policymakers by highlighting the limitations of traditional monetary policy frameworks and the need for country-specific approaches. It also advances the understanding of financial transmission mechanisms in diverse economic contexts.

Technical Contribution

The study develops a comprehensive meta-analytic framework that integrates diverse datasets and econometric techniques to assess monetary policy impacts with greater statistical rigor.

Novelty

This work introduces a novel synthesis of global empirical evidence on monetary policy, emphasizing heterogeneous effects across economies and providing a more nuanced understanding of policy effectiveness.

Limitations

- Reliance on existing empirical studies may limit the scope of findings.

- Potential residual publication bias could affect the reliability of results.

Future Work

- Further research could explore the impact of institutional factors on monetary policy effectiveness.

- Longitudinal studies could examine evolving monetary transmission mechanisms over time.

- More granular analysis of specific economic sectors might reveal additional insights.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMonetary policy and the racial wage gap

Ram Sewak Dubey, Eric Olson, Edmond Berisha

Comments (0)