Summary

Investment style groups investment approaches to predict portfolio return variations. This study examines the relationship between investment style, style consistency, and risk-adjusted returns of Indian equity mutual funds. The methodology involves estimating size and style beta coefficients, identifying breakpoints, analysing investment styles, and assessing risk-shifting intensity. Funds transition across styles over time, reflecting rotation, drift, or strengthening trends. Many Mid Blend funds remain in the same category, while others shift to Large Blend or Mid Value, indicating value-oriented strategies or large-cap exposure. Some funds adopt high-return styles like Small Value and Small Blend, aiming for alpha through small-cap equities. Performance changes following risk structure shifts are analyzed by comparing pre- and post-shift metrics, showing that style adjustments can enhance returns based on market conditions. This study contributes to mutual fund evaluation literature by highlighting the impact of style transitions on returns.

AI Key Findings

Generated Oct 24, 2025

Methodology

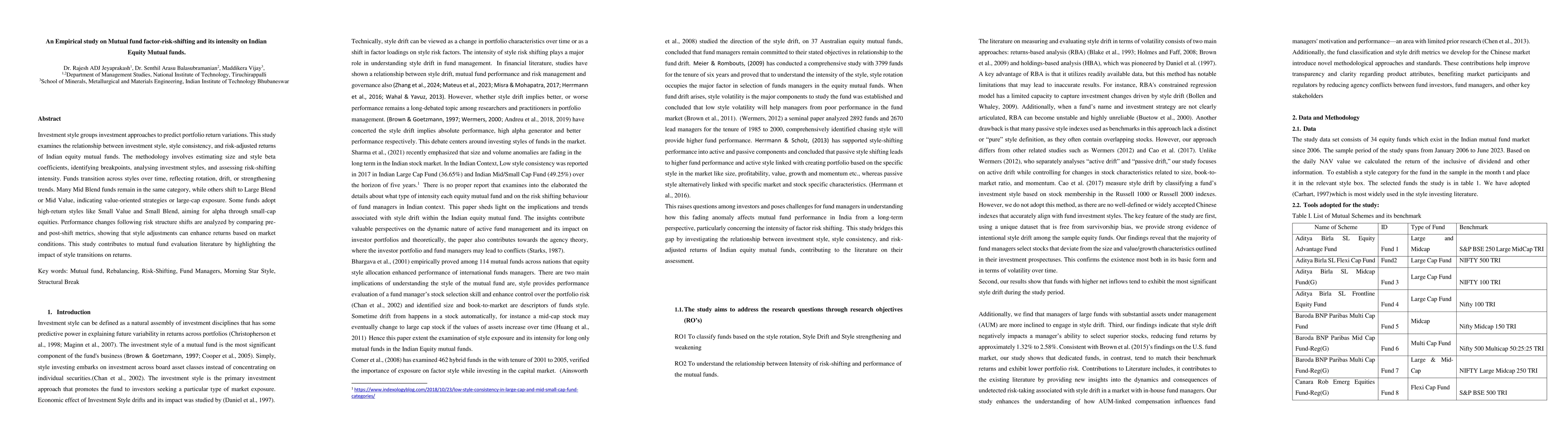

The study employs a combination of beta coefficient estimation, structural break analysis using the Bai-Perron procedure, and performance comparison metrics to assess mutual fund style shifts and their impact on returns. It utilizes Fama-French 3-factor and AGT models for alpha calculation and evaluates funds based on risk-adjusted returns.

Key Results

- Funds with 2-3 structural breaks show the highest excess returns (7.89% and 7.64%) and significantly better Sharpe ratios (0.59 and 0.49) compared to static funds.

- Moderate risk-shifting is positively correlated with superior fund performance, while excessive risk-shifting (4-5 breaks) leads to diminishing returns and mixed alpha values.

- Top-performing funds often shift into high-return styles like Small Value or Mid Growth, indicating that strategic style adjustments enhance market positioning.

Significance

This research provides actionable insights for fund managers and investors by demonstrating how strategic risk-shifting can improve performance, while excessive changes may harm returns. It highlights the importance of adaptive investment strategies in dynamic markets.

Technical Contribution

The study introduces a nuanced analysis of risk-shifting frequency and its relationship with performance, distinguishing between beneficial moderate shifts and detrimental excessive changes.

Novelty

This work uniquely examines the non-linear relationship between risk-shifting frequency and fund performance, showing that both under- and over-shifting can be detrimental, with optimal performance occurring at 2-3 structural breaks.

Limitations

- The study focuses on Indian mutual funds, limiting generalizability to other markets.

- Reliance on historical data may not capture future market behavior accurately.

Future Work

- Investigating the impact of risk-shifting in different market cycles.

- Analyzing the role of fund manager characteristics in successful style transitions.

Comments (0)