Authors

Summary

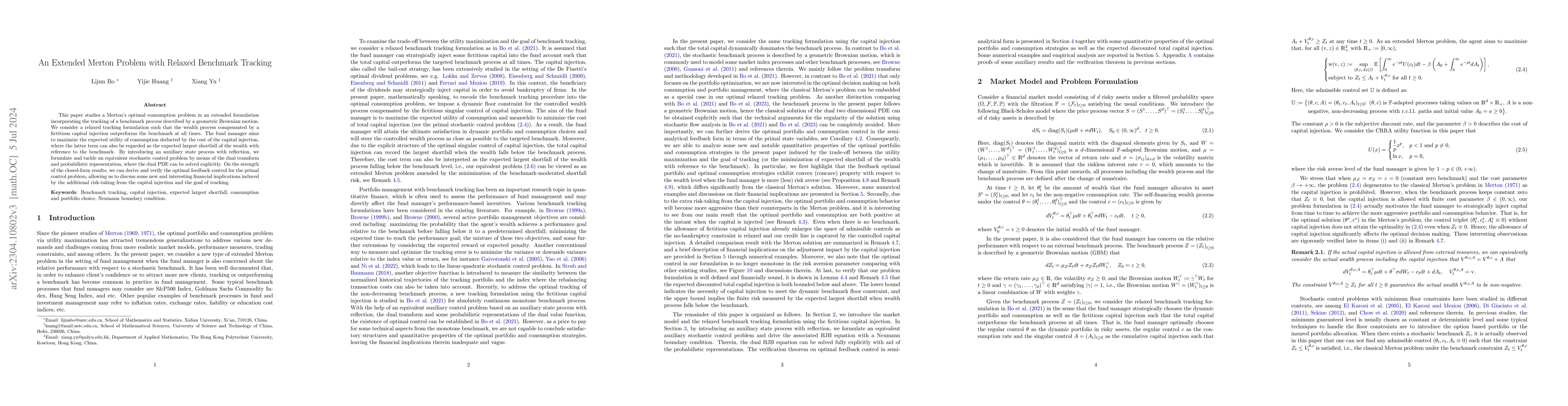

This paper studies a Merton's optimal portfolio and consumption problem in an extended formulation incorporating the tracking of a benchmark process described by a geometric Brownian motion. We consider a relaxed tracking formulation such that the wealth process compensated by a fictitious capital injection outperforms the benchmark at all times. The fund manager aims to maximize the expected utility of consumption deducted by the cost of the capital injection, where the latter term can also be regarded as the expected largest shortfall of the wealth with reference to the benchmark. By introducing an auxiliary state process with reflection, we formulate and tackle an equivalent stochastic control problem by means of the dual transform and probabilistic representation, where the dual PDE can be solved explicitly. On the strength of the closed-form results, we can derive and verify the optimal feedback control for the primal control problem, allowing us to discuss some new and interesting financial implications induced by the additional risk-taking from the capital injection and the goal of tracking.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic control problems with state-reflections arising from relaxed benchmark tracking

Xiang Yu, Lijun Bo, Yijie Huang

Optimal consumption under relaxed benchmark tracking and consumption drawdown constraint

Xiang Yu, Lijun Bo, Yijie Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)