Summary

Range-measured return contains more information than the traditional scalar-valued return. In this paper, we propose to model the [low, high] price range as a random interval and suggest an interval-valued GARCH (Int-GARCH) model for the corresponding range-measured return process. Under the general framework of random sets, the model properties are investigated. Parameters are estimated by the maximum likelihood method, and the asymptotic properties are established. Empirical application to stocks and financial indices data sets suggests that our Int-GARCH model overall outperforms the traditional GARCH for both in-sample estimation and out-of-sample prediction of volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

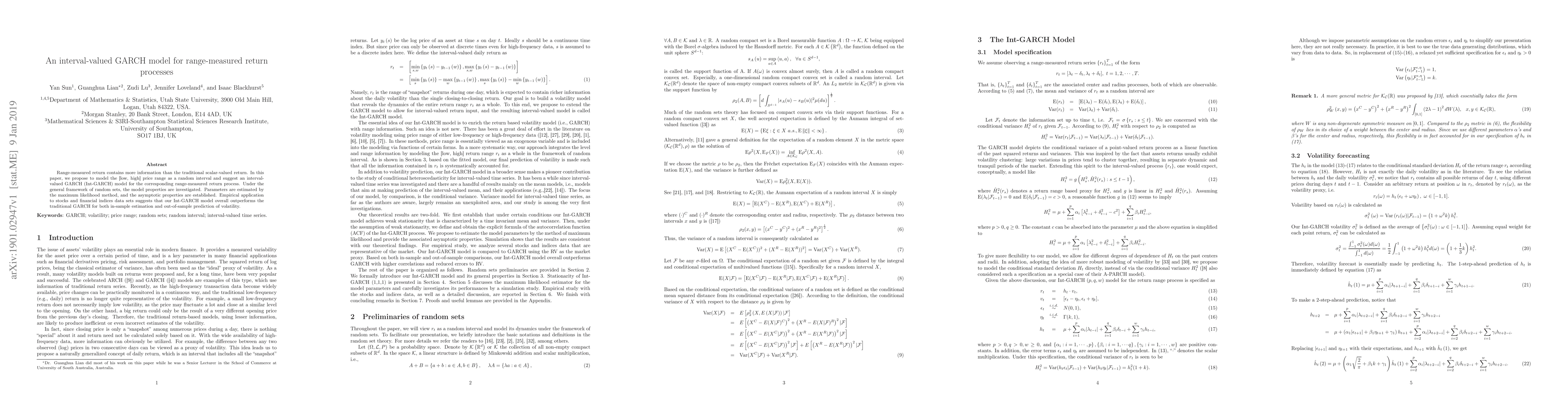

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhanced Prediction Model for Time Series Characterized by GARCH via Interval Type-2 Fuzzy Inference System

Shaohong Pei, Da-Qing Zhang, Feilong Lu

No citations found for this paper.

Comments (0)