Summary

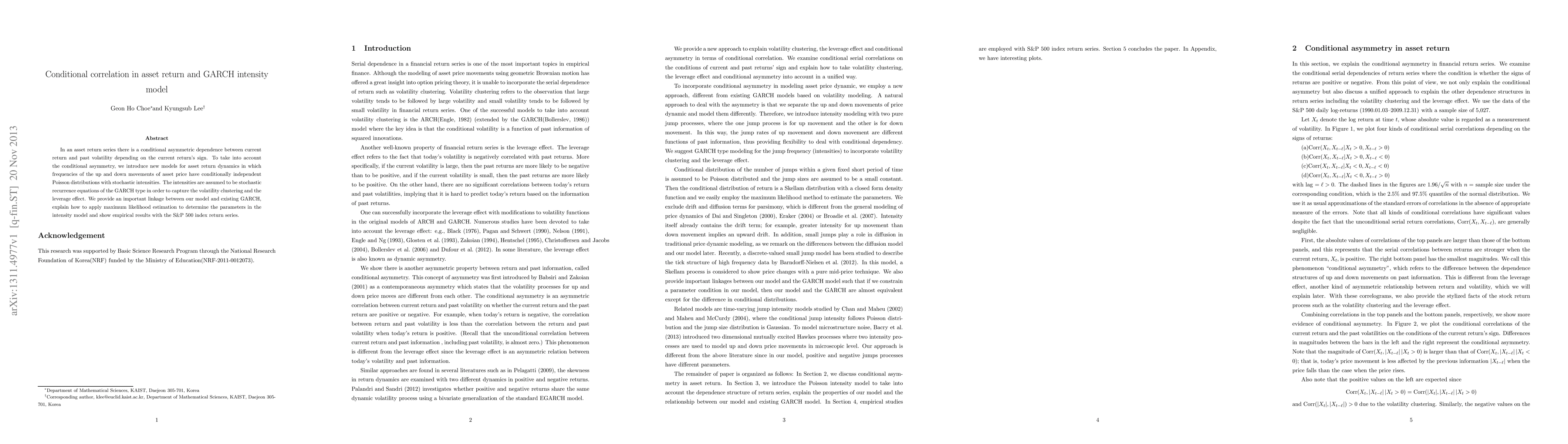

In an asset return series there is a conditional asymmetric dependence between current return and past volatility depending on the current return's sign. To take into account the conditional asymmetry, we introduce new models for asset return dynamics in which frequencies of the up and down movements of asset price have conditionally independent Poisson distributions with stochastic intensities. The intensities are assumed to be stochastic recurrence equations of the GARCH type in order to capture the volatility clustering and the leverage effect. We provide an important linkage between our model and existing GARCH, explain how to apply maximum likelihood estimation to determine the parameters in the intensity model and show empirical results with the S&P 500 index return series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGraphical copula GARCH modeling with dynamic conditional dependence

Lupe Shun Hin Chan, Amanda Man Ying Chu, Mike Ka Pui So

No citations found for this paper.

Comments (0)