Authors

Summary

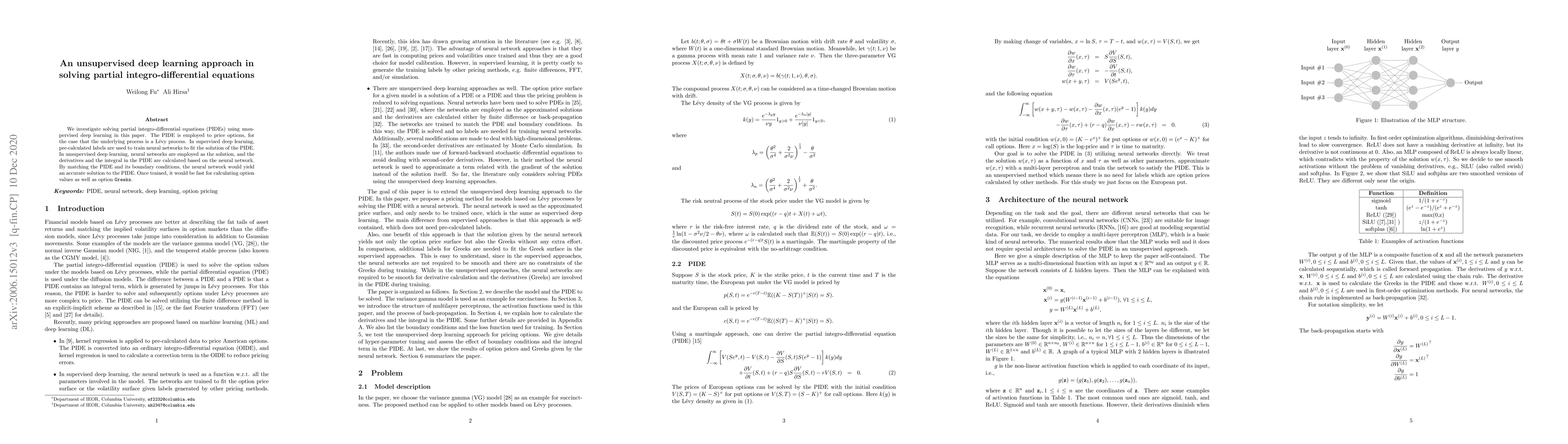

We investigate solving partial integro-differential equations (PIDEs) using unsupervised deep learning in this paper. To price options, assuming underlying processes follow Levy processes, we require to solve PIDEs. In supervised deep learning, pre-calculated labels are used to train neural networks to fit the solution of the PIDE. In an unsupervised deep learning, neural networks are employed as the solution, and the derivatives and the integrals in the PIDE are calculated based on the neural network. By matching the PIDE and its boundary conditions, the neural network gives an accurate solution of the PIDE. Once trained, it would be fast for calculating options values as well as option Greeks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFBSJNN: A Theoretically Interpretable and Efficiently Deep Learning method for Solving Partial Integro-Differential Equations

Wansheng Wang, Zaijun Ye

| Title | Authors | Year | Actions |

|---|

Comments (0)