Summary

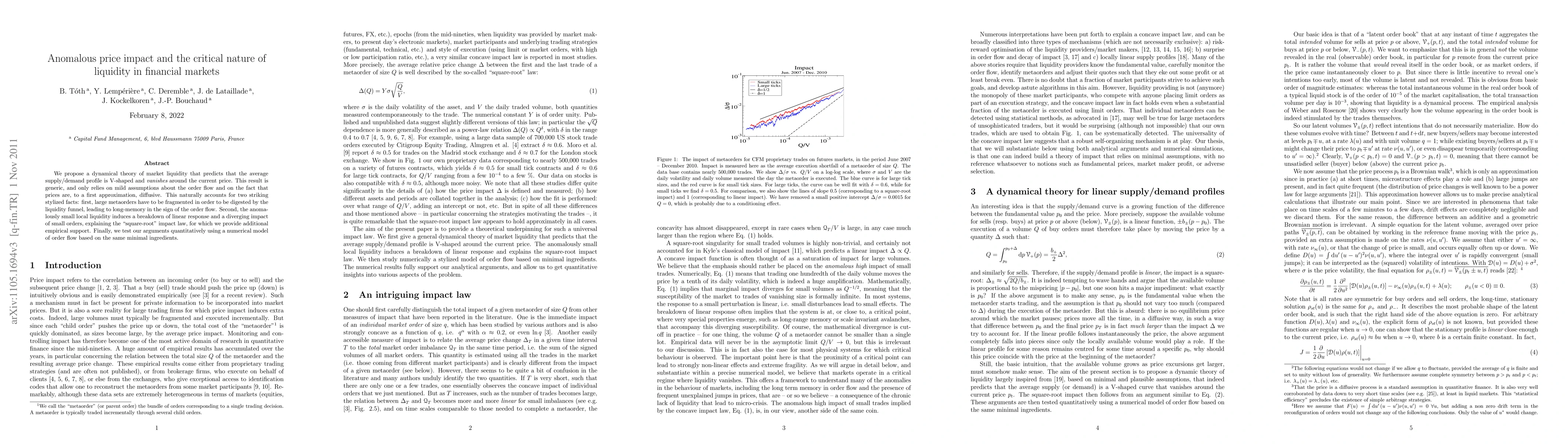

We propose a dynamical theory of market liquidity that predicts that the average supply/demand profile is V-shaped and {\it vanishes} around the current price. This result is generic, and only relies on mild assumptions about the order flow and on the fact that prices are (to a first approximation) diffusive. This naturally accounts for two striking stylized facts: first, large metaorders have to be fragmented in order to be digested by the liquidity funnel, leading to long-memory in the sign of the order flow. Second, the anomalously small local liquidity induces a breakdown of linear response and a diverging impact of small orders, explaining the "square-root" impact law, for which we provide additional empirical support. Finally, we test our arguments quantitatively using a numerical model of order flow based on the same minimal ingredients.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAgent-based Liquidity Risk Modelling for Financial Markets

Tao Chen, Perukrishnen Vytelingum, Jianfei Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)