Summary

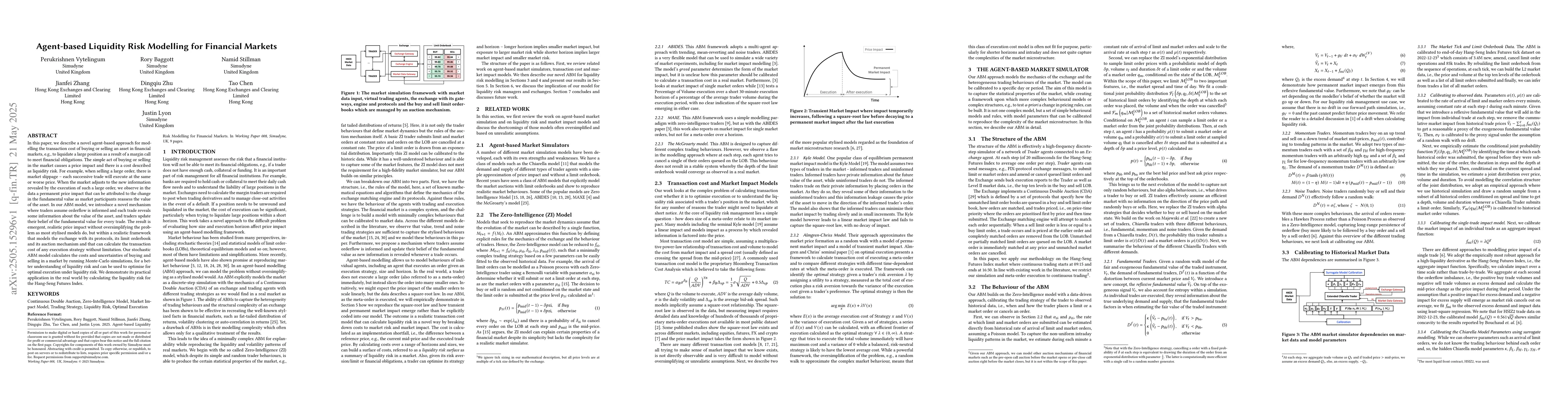

In this paper, we describe a novel agent-based approach for modelling the transaction cost of buying or selling an asset in financial markets, e.g., to liquidate a large position as a result of a margin call to meet financial obligations. The simple act of buying or selling in the market causes a price impact and there is a cost described as liquidity risk. For example, when selling a large order, there is market slippage -- each successive trade will execute at the same or worse price. When the market adjusts to the new information revealed by the execution of such a large order, we observe in the data a permanent price impact that can be attributed to the change in the fundamental value as market participants reassess the value of the asset. In our ABM model, we introduce a novel mechanism where traders assume orderflow is informed and each trade reveals some information about the value of the asset, and traders update their belief of the fundamental value for every trade. The result is emergent, realistic price impact without oversimplifying the problem as most stylised models do, but within a realistic framework that models the exchange with its protocols, its limit orderbook and its auction mechanism and that can calculate the transaction cost of any execution strategy without limitation. Our stochastic ABM model calculates the costs and uncertainties of buying and selling in a market by running Monte-Carlo simulations, for a better understanding of liquidity risk and can be used to optimise for optimal execution under liquidity risk. We demonstrate its practical application in the real world by calculating the liquidity risk for the Hang-Seng Futures Index.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research employs an agent-based modeling (ABM) approach to simulate financial markets, focusing on transaction costs and liquidity risk. The model incorporates a limit order book, auction mechanisms, and stochastic simulations via Monte Carlo methods to calculate costs and uncertainties for any execution strategy.

Key Results

- Introduces a novel ABM for modeling liquidity risk, considering informed order flow where trades reveal information about asset value.

- Demonstrates the emergence of realistic price impact without oversimplification, capturing permanent price adjustments due to large orders.

- Provides a framework to calculate transaction costs for any execution strategy, with practical application shown through Hang-Seng Futures Index example.

Significance

This research is significant as it offers a more realistic and comprehensive model for liquidity risk assessment, enabling better execution strategy optimization and improved understanding of market dynamics.

Technical Contribution

The development of a stochastic agent-based model that calculates liquidity risk and transaction costs by simulating informed trading and order book dynamics.

Novelty

The proposed ABM differs from existing models by explicitly considering informed order flow and its impact on traders' beliefs about asset fundamental value, providing a more nuanced representation of liquidity risk.

Limitations

- The model's accuracy depends on the quality and assumptions made about trader behavior and information processing.

- Real-world complexities, such as regulatory changes or market shocks, may not be fully captured within the ABM framework.

Future Work

- Explore incorporating additional market factors, like news events or regulatory changes, to enhance model realism.

- Investigate the model's applicability to other asset classes and markets beyond futures indices.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSimulating Liquidity: Agent-Based Modeling of Illiquid Markets for Fractional Ownership

A. Ege Yilmaz, Thomas Ankenbrand, Lars Fluri et al.

No citations found for this paper.

Comments (0)