Summary

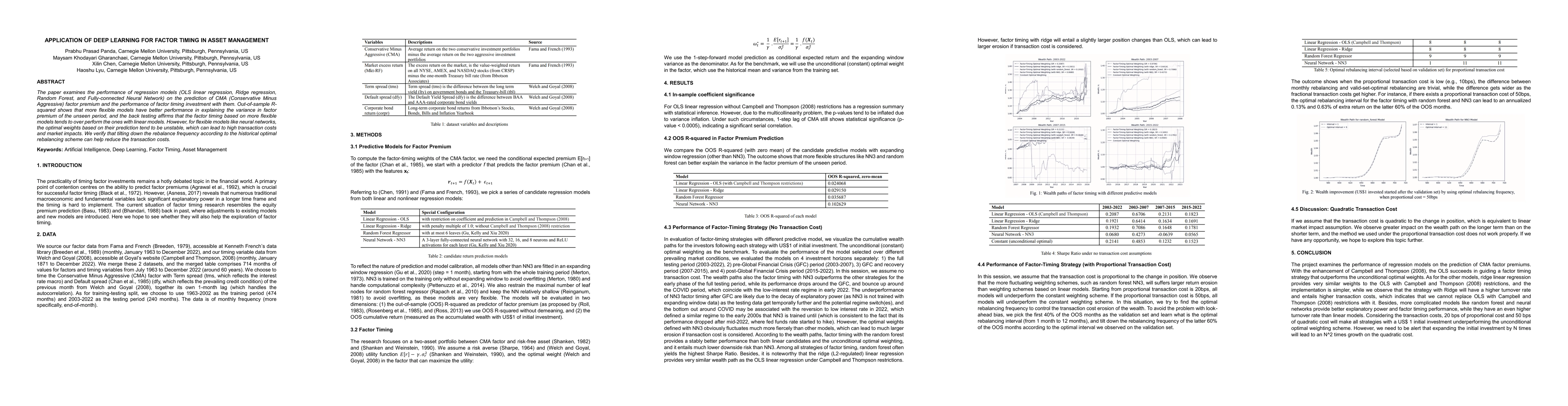

The paper examines the performance of regression models (OLS linear regression, Ridge regression, Random Forest, and Fully-connected Neural Network) on the prediction of CMA (Conservative Minus Aggressive) factor premium and the performance of factor timing investment with them. Out-of-sample R-squared shows that more flexible models have better performance in explaining the variance in factor premium of the unseen period, and the back testing affirms that the factor timing based on more flexible models tends to over perform the ones with linear models. However, for flexible models like neural networks, the optimal weights based on their prediction tend to be unstable, which can lead to high transaction costs and market impacts. We verify that tilting down the rebalance frequency according to the historical optimal rebalancing scheme can help reduce the transaction costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Role of Deep Learning in Financial Asset Management: A Systematic Review

João Gama, Pedro Reis, Ana Paula Serra

Hierarchical Deep Reinforcement Learning Framework for Multi-Year Asset Management Under Budget Constraints

Amir Fard, Arnold X. -X. Yuan

| Title | Authors | Year | Actions |

|---|

Comments (0)