Authors

Summary

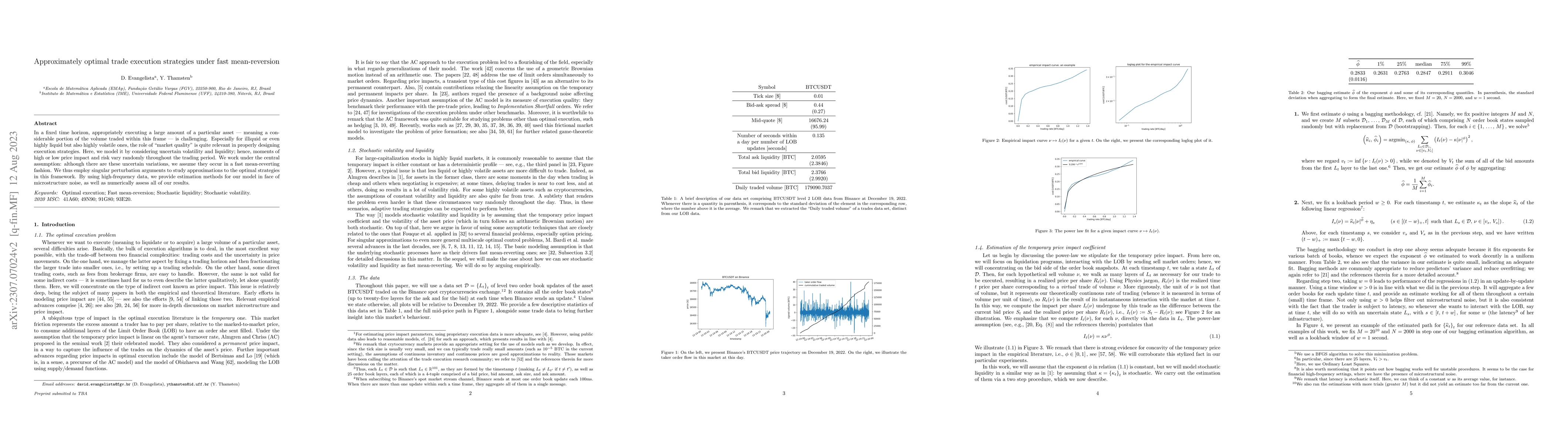

In a fixed time horizon, appropriately executing a large amount of a particular asset -- meaning a considerable portion of the volume traded within this frame -- is challenging. Especially for illiquid or even highly liquid but also highly volatile ones, the role of "market quality" is quite relevant in properly designing execution strategies. Here, we model it by considering uncertain volatility and liquidity; hence, moments of high or low price impact and risk vary randomly throughout the trading period. We work under the central assumption: although there are these uncertain variations, we assume they occur in a fast mean-reverting fashion. We thus employ singular perturbation arguments to study approximations to the optimal strategies in this framework. By using high-frequency data, we provide estimation methods for our model in face of microstructure noise, as well as numerically assess all of our results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)