Authors

Summary

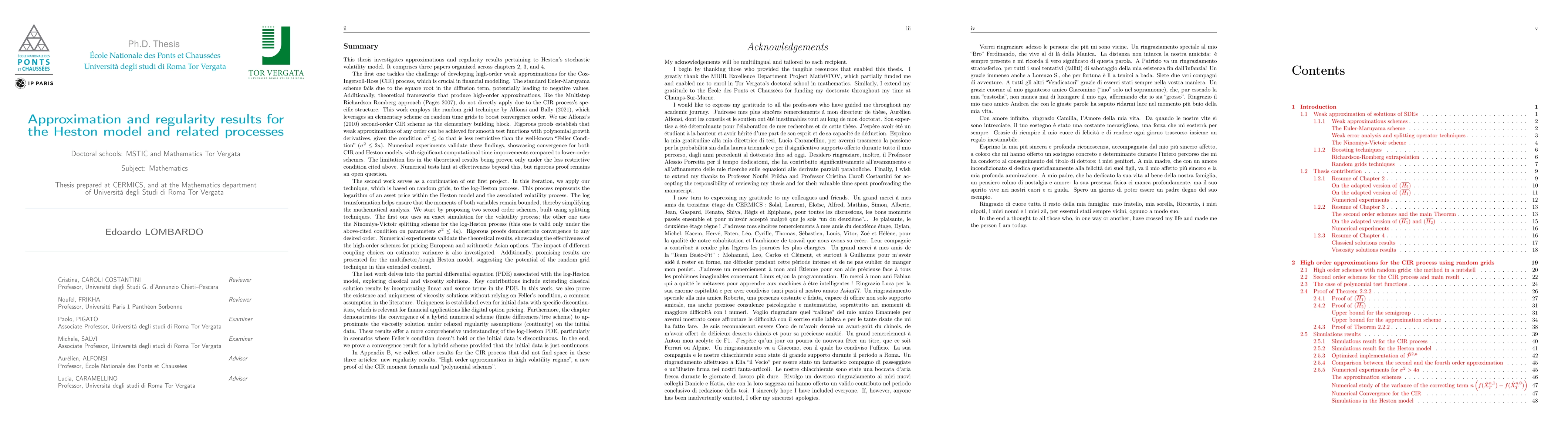

This Ph.D. thesis explores approximations and regularity for the Heston stochastic volatility model through three interconnected works. The first work focuses on developing high-order weak approximations for the Cox-Ingersoll-Ross (CIR) process, essential for financial modelling but challenging due to the square root diffusion term preventing standard methods. By employing the random grid technique (Alfonsi & Bally, 2021) built upon Alfonsi's (2010) second-order scheme, the work proves that weak approximations of any order can be achieved for smooth test functions. This holds under a condition that is less restrictive than the famous Feller's one. Numerical results confirm convergence for both CIR and Heston models and show significant computational time improvements. The second work extends the random grid technique to the log-Heston process. Two second-order schemes are introduced (one using exact volatility simulation, another using Ninomiya-Victoir splitting under a the same restriction used above). Convergence to any desired order is rigorously proven. Numerical experiments validate the schemes' effectiveness for pricing European and Asian options and suggest potential applicability to multifactor/rough Heston models. The third work investigates the partial differential equation (PDE) associated with the log-Heston model. It extends classical solution results and establishes the existence and uniqueness of viscosity solutions without relying on the Feller condition. Uniqueness is proven even for certain discontinuous initial data, relevant for pricing instruments like digital options. Furthermore, the convergence of a hybrid numerical scheme to the viscosity solution is shown under relaxed regularity (continuity) for the initial data. An appendix includes supplementary results for the CIR process.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research employs the random grid technique, building on Alfonsi's (2010) second-order scheme, to develop high-order weak approximations for the CIR process and extends this to the log-Heston process, introducing second-order schemes for both exact volatility simulation and Ninomiya-Victoir splitting.

Key Results

- High-order weak approximations of any order for smooth test functions achieved for the CIR process with a less restrictive condition than Feller's.

- Second-order schemes for the log-Heston process proven to converge to any desired order, validated through numerical experiments for option pricing.

- Extension of classical solution results for the log-Heston model PDE, establishing existence and uniqueness of viscosity solutions without the Feller condition, applicable even for discontinuous initial data.

Significance

This research enhances the numerical treatment of the Heston model and related processes, improving computational efficiency for financial applications like option pricing, and broadening the applicability of existing methods to more complex models.

Technical Contribution

The development of high-order weak approximations for the CIR process and the extension of these methods to the log-Heston process, alongside proving convergence and existence of viscosity solutions for the log-Heston model PDE without the Feller condition.

Novelty

The work introduces less restrictive conditions for weak approximations and extends solution results for the log-Heston model PDE, distinguishing itself from previous research by providing more flexible and broader applicability in financial modeling.

Limitations

- The paper does not address the impact of high-dimensional problems or the scalability of the methods for extensive financial portfolios.

- Limited discussion on the practical implementation challenges and computational costs for real-world applications.

Future Work

- Exploring the applicability of these methods to high-dimensional problems and large-scale financial portfolios.

- Investigating further the computational costs and practical implementation challenges for real-world scenarios.

Paper Details

PDF Preview

Similar Papers

Found 4 papersThe heat modulated infinite dimensional Heston model and its numerical approximation

Giulia Di Nunno, Gabriel Lord, Fred Espen Benth et al.

Rough Heston model as the scaling limit of bivariate heavy-tailed INAR($\infty$) processes and applications

Zhenyu Cui, Yingli Wang

No citations found for this paper.

Comments (0)