Summary

The study efforts to explore and extend the crisis predictability by synthetically reviewing and comparing a full mixture of early warning models into two constitutions: crisis identifications and predictive models. Given empirical results on Chinese currency and stock markets, three-strata findings are concluded as (i) the SWARCH model conditional on an elastic thresholding methodology can most accurately classify crisis observations and greatly contribute to boosting the predicting precision, (ii) stylized machine learning models are preferred given higher precision in predicting and greater benefit in practicing, (iii) leading factors sign the crisis in a diversified way for different types of markets and varied prediction periods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

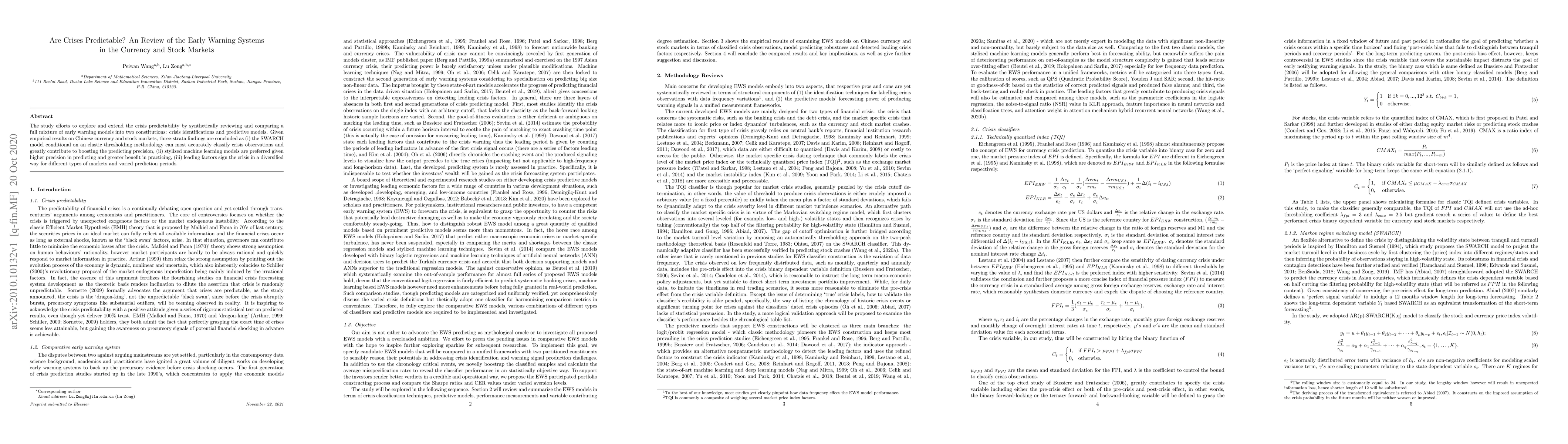

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA systematic review of early warning systems in finance

Ali Namaki, Reza Eyvazloo, Shahin Ramtinnia

| Title | Authors | Year | Actions |

|---|

Comments (0)