Authors

Summary

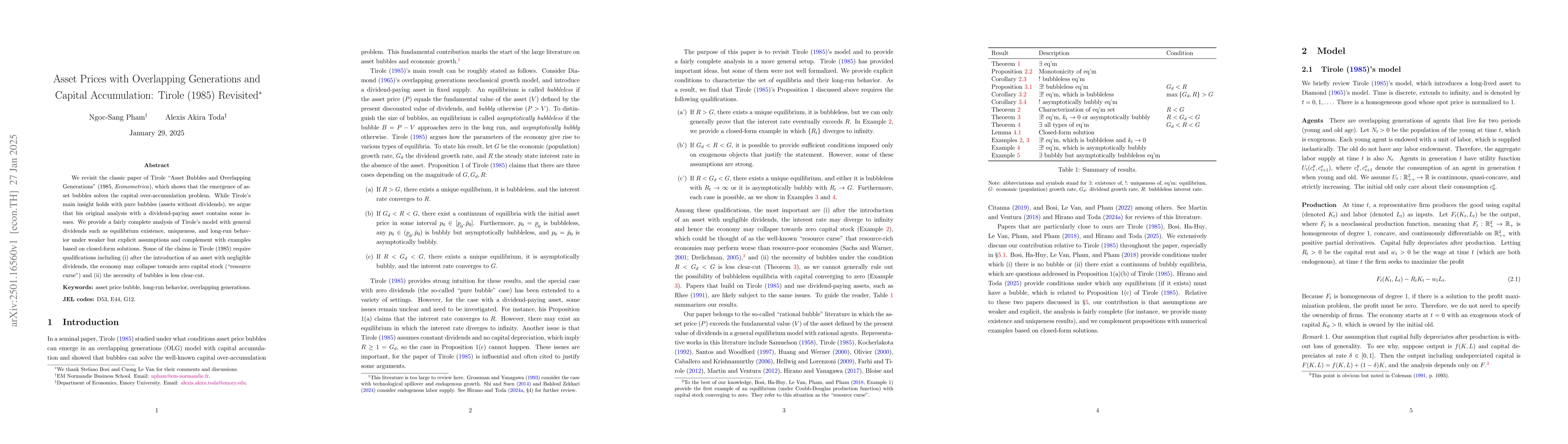

We revisit the classic paper of Tirole "Asset Bubbles and Overlapping Generations" (1985, Econometrica), which shows that the emergence of asset bubbles solves the capital over-accumulation problem. While Tirole's main insight holds with pure bubbles (assets without dividends), we argue that his original analysis with a dividend-paying asset contains some issues. We provide a fairly complete analysis of Tirole's model with general dividends such as equilibrium existence, uniqueness, and long-run behavior under weaker but explicit assumptions and complement with examples based on closed-form solutions. Some of the claims in Tirole (1985) require qualifications including (i) after the introduction of an asset with negligible dividends, the economy may collapse towards zero capital stock ("resource curse") and (ii) the necessity of bubbles is less clear-cut.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersRational Bubbles on Dividend-Paying Assets: A Comment on Tirole (1985)

Alexis Akira Toda, Ngoc-Sang Pham

On Equilibrium Determinacy in Overlapping Generations Models with Money

Alexis Akira Toda, Tomohiro Hirano

No citations found for this paper.

Comments (0)